Question: Question 3 4 pts The expected returns for Stocks A. B, C, D, and E are 7 percent, 10 percent, 1 18 percent, 15 percent,

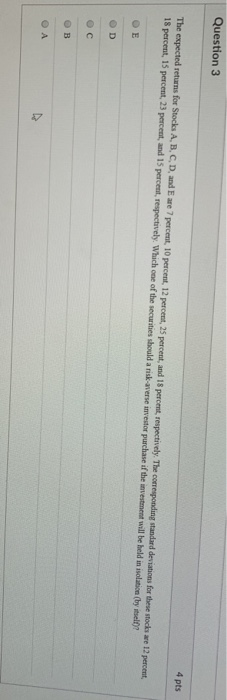

Question 3 4 pts The expected returns for Stocks A. B, C, D, and E are 7 percent, 10 percent, 1 18 percent, 15 percent, 23 percenat, and 15 percest, respectively. Which one of the securities should a risk-averse investor purchase if the investemernt will be held in isolation (by itselt? 12 percent, 25 percent, and 1S percent, respectively. The corresponding standard deviations for these stocks are 12 percent o c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts