Question: Question 3 (40 marks) a. You are 30 years old and are considering full-time study for an MBA degree. Tuition and other direct costs will

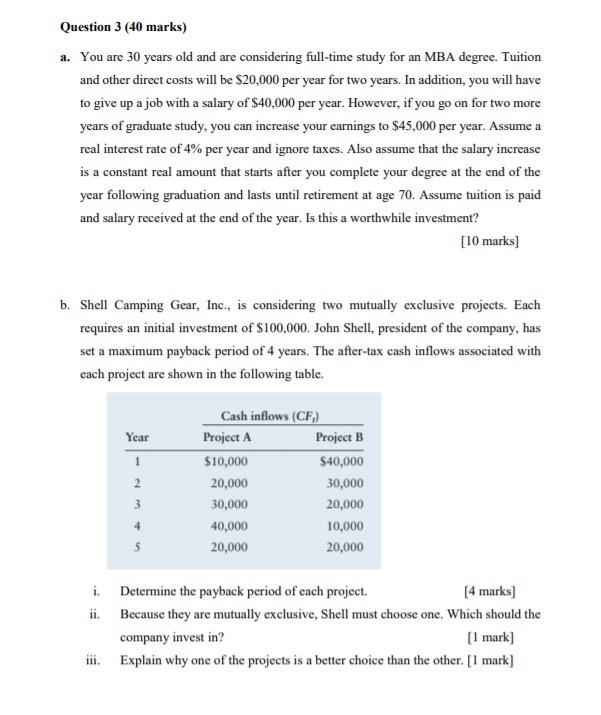

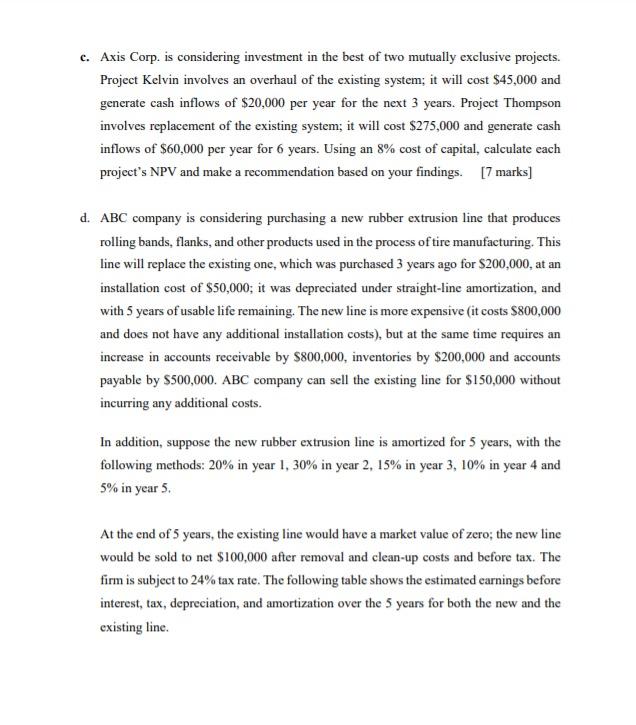

Question 3 (40 marks) a. You are 30 years old and are considering full-time study for an MBA degree. Tuition and other direct costs will be $20,000 per year for two years. In addition, you will have to give up a job with a salary of $40,000 per year. However, if you go on for two more years of graduate study, you can increase your earnings to $45,000 per year. Assume a real interest rate of 4% per year and ignore taxes. Also assume that the salary increase is a constant real amount that starts after you complete your degree at the end of the year following graduation and lasts until retirement at age 70. Assume tuition is paid and salary received at the end of the year. Is this a worthwhile investment? [10 marks] b. Shell Camping Gear, Inc., is considering two mutually exclusive projects. Each requires an initial investment of $100,000. John Shell, president of the company, has set a maximum payback period of 4 years. The after-tax cash inflows associated with each project are shown in the following table. Year 1 2 Cash inflows (CF) Project A Project B $10,000 $40,000 20,000 30,000 30,000 20,000 40,000 10,000 20,000 20,000 3 4 5 i. Determine the payback period of each project. [4 marks] ii. Because they are mutually exclusive, Shell must choose one. Which should the company invest in? [1 mark] Explain why one of the projects is a better choice than the other. [1 mark] III. c. Axis Corp. is considering investment in the best of two mutually exclusive projects. Project Kelvin involves an overhaul of the existing system; it will cost $45,000 and generate cash inflows of $20,000 per year for the next 3 years. Project Thompson involves replacement of the existing system; it will cost $275,000 and generate cash inflows of $60,000 per year for 6 years. Using an 8% cost of capital, calculate each project's NPV and make a recommendation based on your findings. [7 marks] d. ABC company is considering purchasing a new rubber extrusion line that produces rolling bands, flanks, and other products used in the process of tire manufacturing. This line will replace the existing one, which was purchased 3 years ago for $200,000, at an installation cost of $50,000; it was depreciated under straight-line amortization, and with 5 years of usable life remaining. The new line is more expensive (it costs $800,000 and does not have any additional installation costs), but at the same time requires an increase in accounts receivable by $800,000, inventories by $200,000 and accounts payable by $500,000. ABC company can sell the existing line for $150,000 without incurring any additional costs. In addition, suppose the new rubber extrusion line is amortized for 5 years, with the following methods: 20% in year 1, 30% in year 2, 15% in year 3, 10% in year 4 and 5% in year 5. At the end of 5 years, the existing line would have a market value of zero; the new line would be sold to net $100,000 after removal and clean-up costs and before tax. The firm is subject to 24% tax rate. The following table shows the estimated earnings before interest, tax, depreciation, and amortization over the 5 years for both the new and the existing line Year 1 2 Earnings before interest, taxes, depreciation, and amortization Alternative new line Existing line $250,000 $280,000 250,000 250,000 250,000 200,000 250,000 180,000 250,000 150,000 3 4 5 i. Calculate the initial investment associated with the alternative line. [4 marks) ii. Determine the incremental operating cash flows associated with the alternative line replacement. [7.5 marks] iii. Determine the terminal cash flow expected at the end of year 5 from the alternative line replacement [4 marks] iv. Depict on a timeline the incremental cash flows associated with the alternative line replacement decision. [1.5 mark] -END OF PAPER

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts