Question: Question 3 (5 + 5 = 10 marks). a. Zoel enterprise is thinking about introducing their new product as a part of their expansion plan

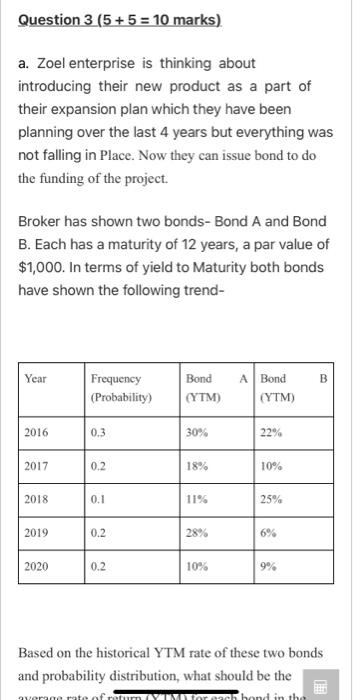

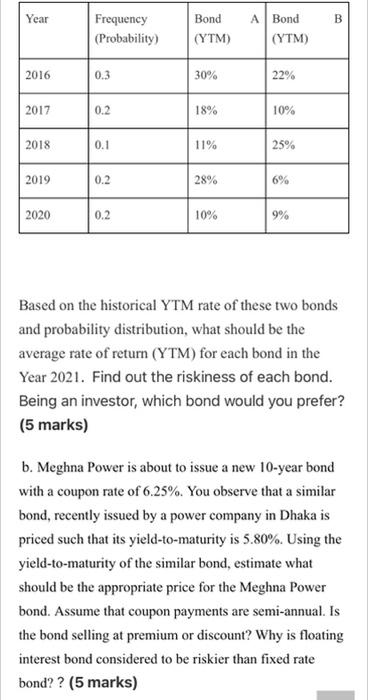

Question 3 (5 + 5 = 10 marks). a. Zoel enterprise is thinking about introducing their new product as a part of their expansion plan which they have been planning over the last 4 years but everything was not falling in Place. Now they can issue bond to do the funding of the project. Broker has shown two bonds-Bond A and Bond B. Each has a maturity of 12 years, a par value of $1,000. In terms of yield to Maturity both bonds have shown the following trend- Year B Frequency (Probability) Bond (YTM) A Bond (YTM) 2016 0.3 30% 22% 2017 0.2 18% 10% 2018 0.1 1194 25% 2019 0.2 28% 2020 0.2 10% 9% Based on the historical YTM rate of these two bonds and probability distribution, what should be the were rate ofron YTY band in the Year B Frequency (Probability) Bond (YTM) A Bond (YTM) 2016 0.3 30% 22% 2017 0.2 18% 10% 2018 0.1 11% 25% 2019 0.2 28% 6% 2020 0.2 10% 9% Based on the historical YTM rate of these two bonds and probability distribution, what should be the average rate of return (YTM) for each bond in the Year 2021. Find out the riskiness of each bond. Being an investor, which bond would you prefer? (5 marks) b. Meghna Power is about to issue a new 10-year bond with a coupon rate of 6.25%. You observe that a similar bond, recently issued by a power company in Dhaka is priced such that its yield-to-maturity is 5.80%. Using the yield-to-maturity of the similar bond, estimate what should be the appropriate price for the Meghna Power bond. Assume that coupon payments are semi-annual. Is the bond selling at premium or discount? Why is floating interest bond considered to be riskier than fixed rate bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts