Question: Question 3 ( 5 marks ) Toppies Limited is entering the Namibian market. They have decided to test the market with one of the most

Question

marks

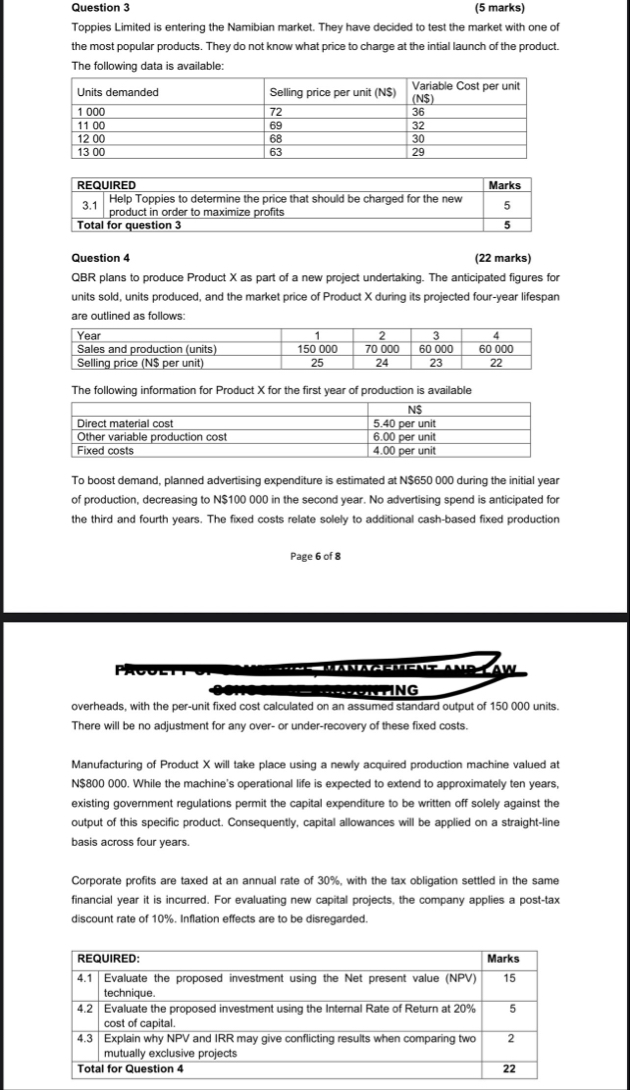

Toppies Limited is entering the Namibian market. They have decided to test the market with one of the most popular products. They do not know what price to charge at the intial launch of the product. The following data is available:

tableUnits demanded,Selling price per unit N$tableVariable Cost per unitN$

tableREQUIREDMarkstableHelp Toppies to determine the price that should be charged for the newproduct in order to maximize profitsTotal for question

Question

marks

QBR plans to produce Product as part of a new project undertaking. The anticipated figures for units sold, units produced, and the market price of Product X during its projected fouryear lifespan are outlined as follows:

tableYearSales and production unitsSelling price N$ per unit

The following information for Product X for the first year of production is available

tableN$Direct material cost, per unitOther variable production cost, per unitFixed costs, per unit

To boost demand, planned advertising expenditure is estimated at N$ during the initial year of production, decreasing to N$ in the second year. No advertising spend is anticipated for the third and fourth years. The fixed costs relate solely to additional cashbased fixed production

Page of

overheads, with the perunit fixed cost calculated on an assumed standard output of units. There will be no adjustment for any over or underrecovery of these fixed costs.

Manufacturing of Product X will take place using a newly acquired production machine valued at N$ While the machine's operational life is expected to extend to approximately ten years, existing government regulations permit the capital expenditure to be written off solely against the output of this specific product. Consequently, capital allowances will be applied on a straightline basis across four years.

Corporate profits are taxed at an annual rate of with the tax obligation settled in the same financial year i

Question

marks

Toppies Limited is entering the Namibian market. They have decided to test the market with one of the most popular products. They do not know what price to charge at the intial launch of the product. The following data is available:

tableUnits demanded,Selling price per unit N$tableVariable Cost per unitN$

tableREQUIREDMarkstableHelp Toppies to determine the price that should be charged for the newproduct in order to maximize profitsTotal for question

Question

marks

QBR plans to produce Product as part of a new project undertaking. The anticipated figures for units sold, units produced, and the market price of Product X during its projected fouryear lifespan are outlined as follows:

tableYearSales and production unitsSelling price N$ per unit

The following information for Product X for the first year of production is available

tableN$Direct material cost, per unitOther variable production cost, per unitFixed costs, per unit

To boost demand, planned advertising expenditure is estimated at N$ during the initial year of production, decreasing to N$ in the second year. No advertising spend is anticipated for the third and fourth years. The fixed costs relate solely to additional cashbased fixed production

overheads, with the perunit fixed cost calculated on an assumed standard output of units. There will be no adjustment for any over or underrecovery of these fixed costs.

Manufacturing of Product X will take place using a newly acquired production machine valued at N$ While the machine's operational life is expected to extend to approximately ten years, existing government regulations permit the capital expenditure to be written off solely against the output of this specific product. Consequently, capital allowances will be applied on a straightline basis across four years.

Corporate profits are taxed at an annual rate of with the tax obligation settled in the same financial year it is incurred. For evaluating new capital projects, the company applies a posttax discount rate of Inflation effects are to be disregarded.

tableREQUIRED:MarksEvaluate the proposed investment using the Net present value NPV technique.,Evaluate the proposed investment using the Internal Rate of Return at cost of capital.,Explain why NPV and IRR may give conflicting results when comparing two mutually exclusive projects,Total for Question

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock