Question: Question 3 (5 points. Please demonstrate calculations clearly.) A developer puts in 10% equity, while a PE fund invests 90% of the equity for a

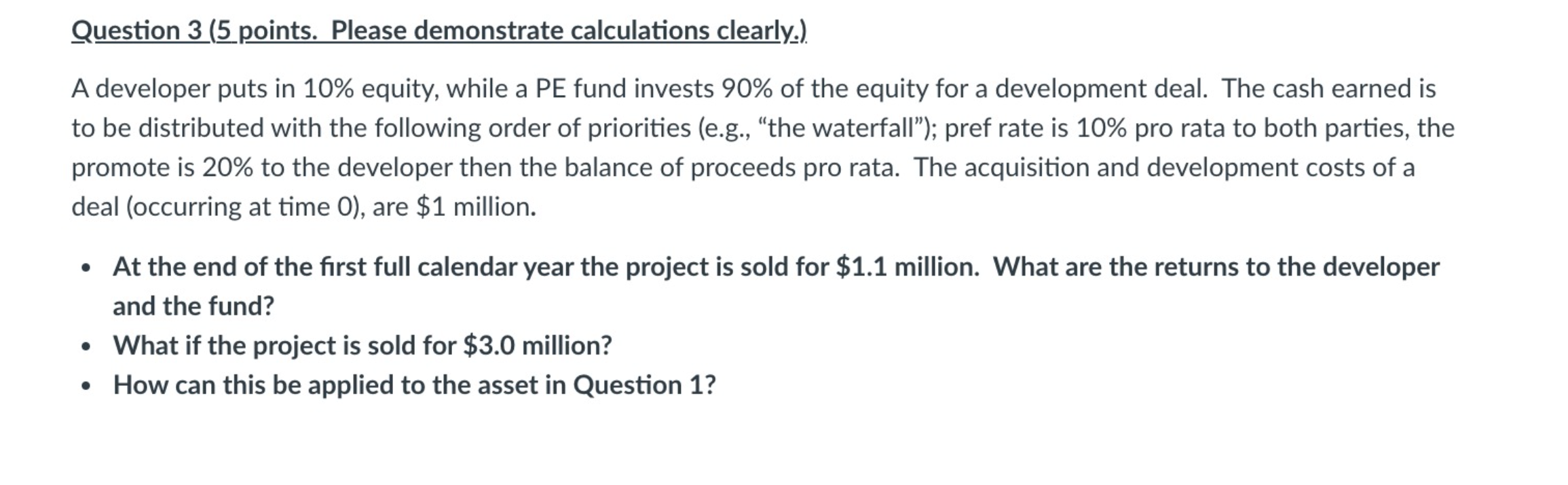

Question 3 (5 points. Please demonstrate calculations clearly.) A developer puts in 10% equity, while a PE fund invests 90% of the equity for a development deal. The cash earned is to be distributed with the following order of priorities (e.g., "the waterfall"); pref rate is 10% pro rata to both parties, the promote is 20% to the developer then the balance of proceeds pro rata. The acquisition and development costs of a deal (occurring at time 0), are $1 million. At the end of the first full calendar year the project is sold for $1.1 million. What are the returns to the developer and the fund? What if the project is sold for $3.0 million? How can this be applied to the asset in Question 1? . Question 3 (5 points. Please demonstrate calculations clearly.) A developer puts in 10% equity, while a PE fund invests 90% of the equity for a development deal. The cash earned is to be distributed with the following order of priorities (e.g., "the waterfall"); pref rate is 10% pro rata to both parties, the promote is 20% to the developer then the balance of proceeds pro rata. The acquisition and development costs of a deal (occurring at time 0), are $1 million. At the end of the first full calendar year the project is sold for $1.1 million. What are the returns to the developer and the fund? What if the project is sold for $3.0 million? How can this be applied to the asset in Question 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts