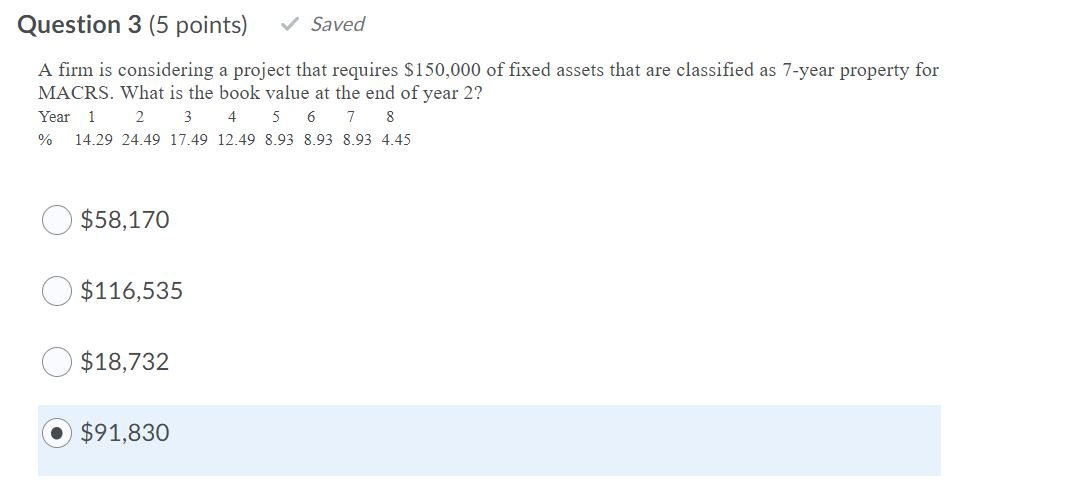

Question: Question 3 (5 points) Saved A firm is considering a project that requires $150,000 of fixed assets that are classified as 7-year property for MACRS.

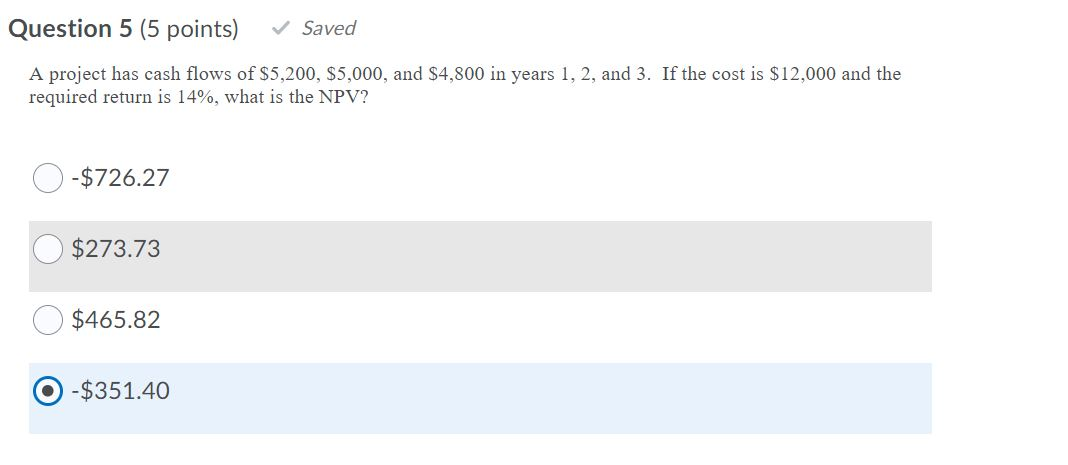

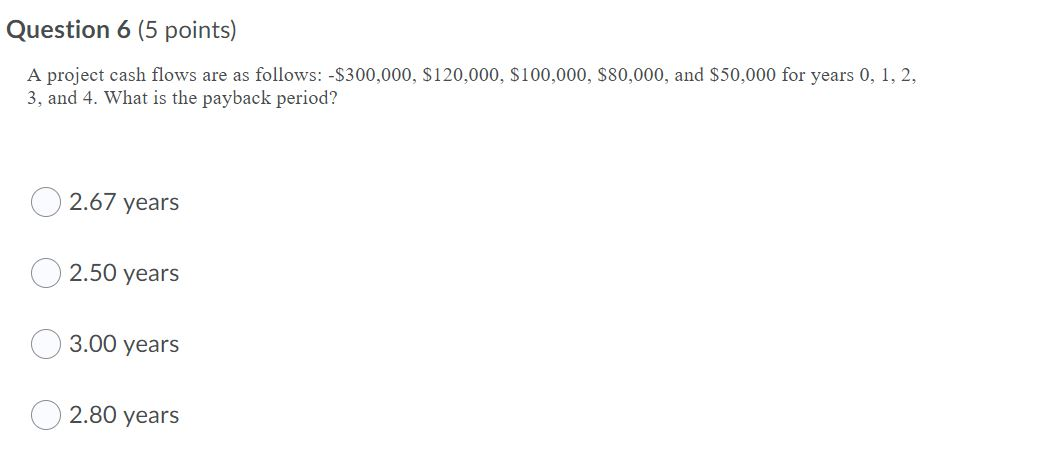

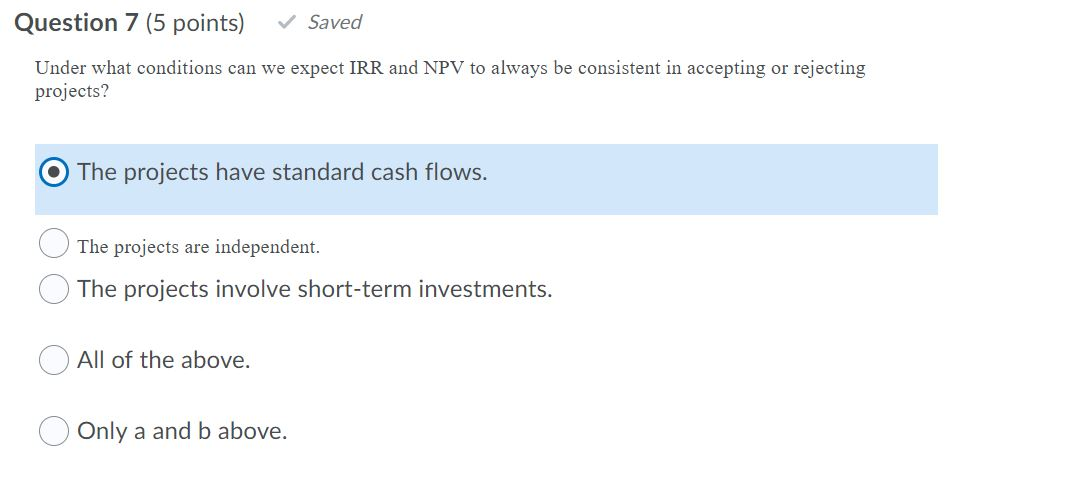

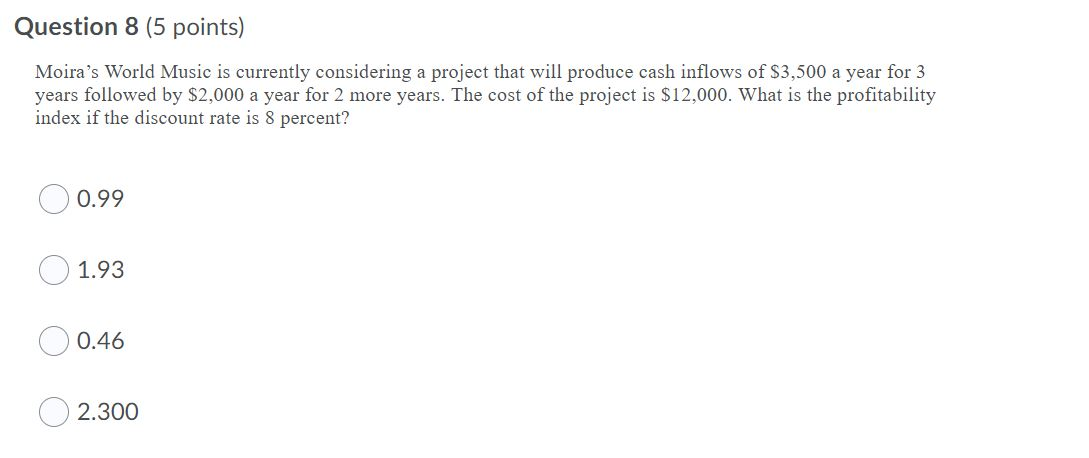

Question 3 (5 points) Saved A firm is considering a project that requires $150,000 of fixed assets that are classified as 7-year property for MACRS. What is the book value at the end of year 2? Year 1 3 4 5 6 7 14.29 24.49 17.49 12.49 8.93 8.93 8.93 4.45 2 8 % $58,170 $116,535 $18,732 $91,830 Question 5 (5 points) Saved A project has cash flows of $5,200, $5,000, and $4,800 in years 1, 2, and 3. If the cost is $12,000 and the required return is 14%, what is the NPV? -$726.27 $273.73 $465.82 -$351.40 Question 6 (5 points) A project cash flows are as follows:-$300,000, $120,000, $100,000, $80,000, and $50,000 for years 0, 1, 2, 3, and 4. What is the payback period? 2.67 years 2.50 years 3.00 years 2.80 years Question 7 (5 points) Saved Under what conditions can we expect IRR and NPV to always be consistent in accepting or rejecting projects? The projects have standard cash flows. The projects are independent. The projects involve short-term investments. All of the above. Only a and b above. Question 8 (5 points) Moira's World Music is currently considering a project that will produce cash inflows of $3,500 a year for 3 years followed by $2,000 a year for 2 more years. The cost of the project is $12,000. What is the profitability index if the discount rate is 8 percent? 0.99 1.93 0.46 2.300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts