Question: Question 3 (50 marks) A Sunshine Ltd, which produces electronic parts in the United Kingdom, has a very strong local market for part no. 55

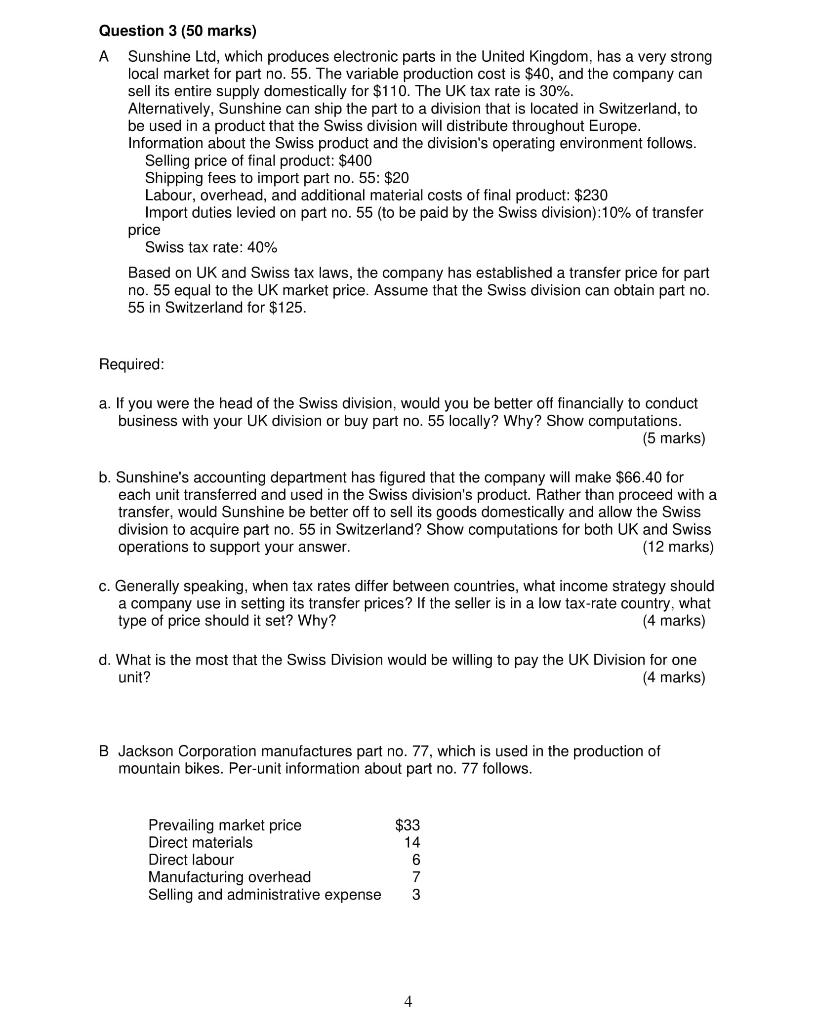

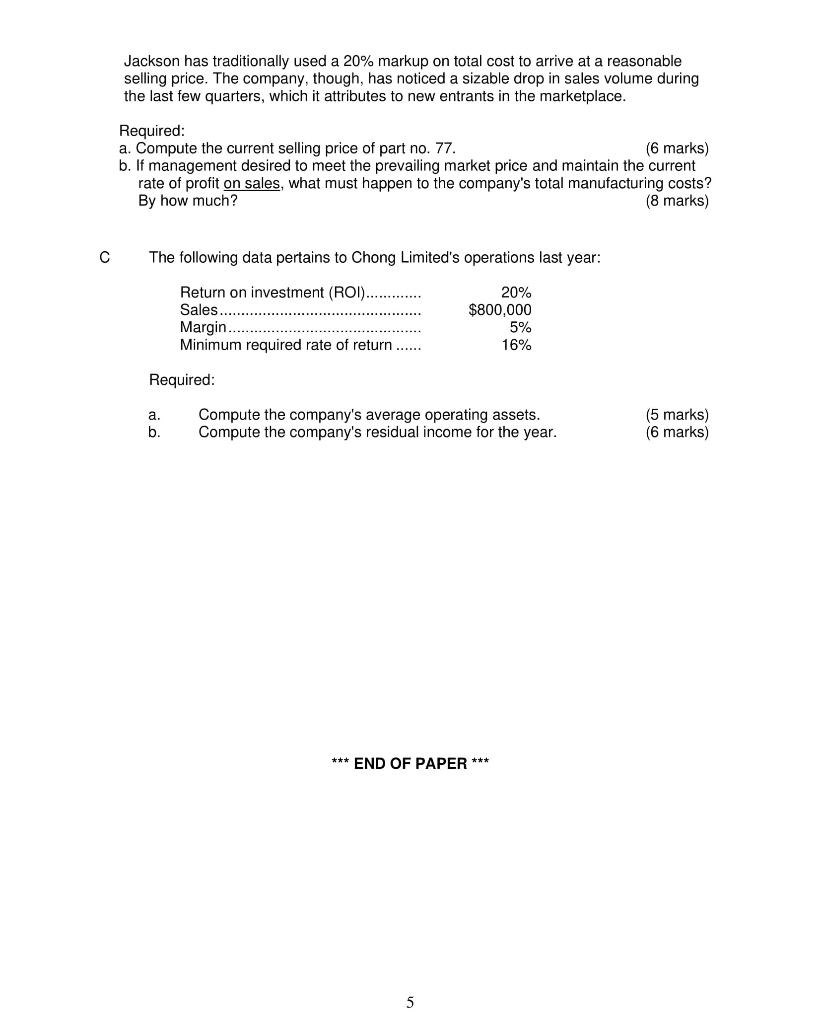

Question 3 (50 marks) A Sunshine Ltd, which produces electronic parts in the United Kingdom, has a very strong local market for part no. 55 . The variable production cost is $40, and the company can sell its entire supply domestically for $110. The UK tax rate is 30%. Alternatively, Sunshine can ship the part to a division that is located in Switzerland, to be used in a product that the Swiss division will distribute throughout Europe. Information about the Swiss product and the division's operating environment follows. Selling price of final product: $400 Shipping fees to import part no. 55: $20 Labour, overhead, and additional material costs of final product: $230 Import duties levied on part no. 55 (to be paid by the Swiss division): 10% of transfer price Swiss tax rate: 40% Based on UK and Swiss tax laws, the company has established a transfer price for part no. 55 equal to the UK market price. Assume that the Swiss division can obtain part no. 55 in Switzerland for $125. Required: a. If you were the head of the Swiss division, would you be better off financially to conduct business with your UK division or buy part no. 55 locally? Why? Show computations. (5 marks) b. Sunshine's accounting department has figured that the company will make $66.40 for each unit transferred and used in the Swiss division's product. Rather than proceed with a transfer, would Sunshine be better off to sell its goods domestically and allow the Swiss division to acquire part no. 55 in Switzerland? Show computations for both UK and Swiss operations to support your answer. (12 marks) c. Generally speaking, when tax rates differ between countries, what income strategy should a company use in setting its transfer prices? If the seller is in a low tax-rate country, what type of price should it set? Why? (4 marks) d. What is the most that the Swiss Division would be willing to pay the UK Division for one unit? (4 marks) B Jackson Corporation manufactures part no. 77, which is used in the production of mountain bikes. Per-unit information about part no. 77 follows. Jackson has traditionally used a 20% markup on total cost to arrive at a reasonable selling price. The company, though, has noticed a sizable drop in sales volume during the last few quarters, which it attributes to new entrants in the marketplace. Required: a. Compute the current selling price of part no. 77. (6 marks) b. If management desired to meet the prevailing market price and maintain the current rate of profit on sales, what must happen to the company's total manufacturing costs? By how much? (8 marks) The following data pertains to Chong Limited's operations last year: Required: a. Compute the company's average operating assets. (5 marks) b. Compute the company's residual income for the year. (6 marks) Question 3 (50 marks) A Sunshine Ltd, which produces electronic parts in the United Kingdom, has a very strong local market for part no. 55 . The variable production cost is $40, and the company can sell its entire supply domestically for $110. The UK tax rate is 30%. Alternatively, Sunshine can ship the part to a division that is located in Switzerland, to be used in a product that the Swiss division will distribute throughout Europe. Information about the Swiss product and the division's operating environment follows. Selling price of final product: $400 Shipping fees to import part no. 55: $20 Labour, overhead, and additional material costs of final product: $230 Import duties levied on part no. 55 (to be paid by the Swiss division): 10% of transfer price Swiss tax rate: 40% Based on UK and Swiss tax laws, the company has established a transfer price for part no. 55 equal to the UK market price. Assume that the Swiss division can obtain part no. 55 in Switzerland for $125. Required: a. If you were the head of the Swiss division, would you be better off financially to conduct business with your UK division or buy part no. 55 locally? Why? Show computations. (5 marks) b. Sunshine's accounting department has figured that the company will make $66.40 for each unit transferred and used in the Swiss division's product. Rather than proceed with a transfer, would Sunshine be better off to sell its goods domestically and allow the Swiss division to acquire part no. 55 in Switzerland? Show computations for both UK and Swiss operations to support your answer. (12 marks) c. Generally speaking, when tax rates differ between countries, what income strategy should a company use in setting its transfer prices? If the seller is in a low tax-rate country, what type of price should it set? Why? (4 marks) d. What is the most that the Swiss Division would be willing to pay the UK Division for one unit? (4 marks) B Jackson Corporation manufactures part no. 77, which is used in the production of mountain bikes. Per-unit information about part no. 77 follows. Jackson has traditionally used a 20% markup on total cost to arrive at a reasonable selling price. The company, though, has noticed a sizable drop in sales volume during the last few quarters, which it attributes to new entrants in the marketplace. Required: a. Compute the current selling price of part no. 77. (6 marks) b. If management desired to meet the prevailing market price and maintain the current rate of profit on sales, what must happen to the company's total manufacturing costs? By how much? (8 marks) The following data pertains to Chong Limited's operations last year: Required: a. Compute the company's average operating assets. (5 marks) b. Compute the company's residual income for the year. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts