Question: Question 3 50 pts From the following data, 1) compute the income tax still due from Schrute University, a proprietary educational institution; and 2) classify

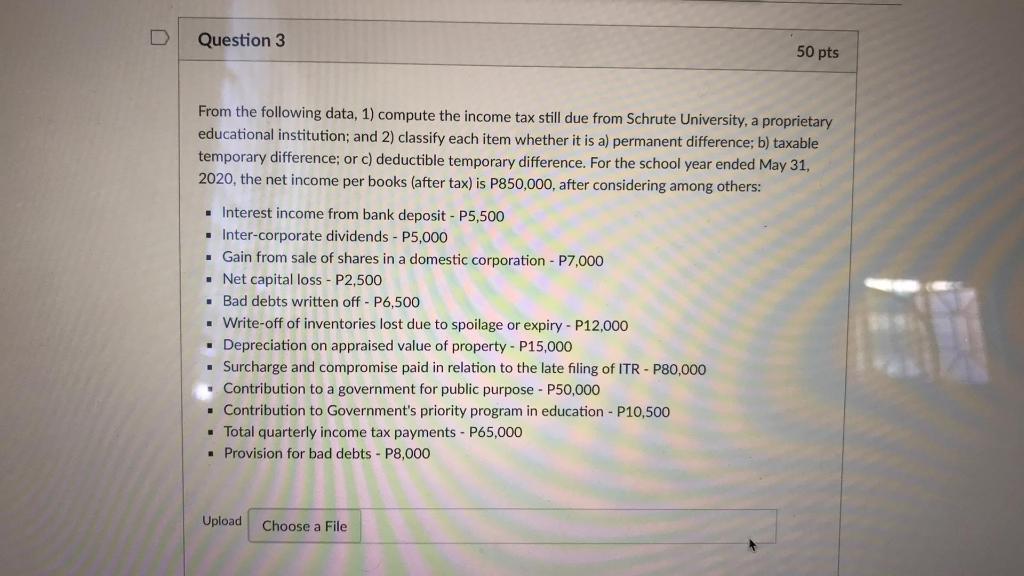

Question 3 50 pts From the following data, 1) compute the income tax still due from Schrute University, a proprietary educational institution; and 2) classify each item whether it is a) permanent difference; b) taxable temporary difference; or c) deductible temporary difference. For the school year ended May 31, 2020, the net income per books (after tax) is P850,000, after considering among others: Interest income from bank deposit - P5,500 Inter-corporate dividends - P5,000 Gain from sale of shares in a domestic corporation - P7,000 Net capital loss - P2,500 . Bad debts written off - P6,500 Write-off of inventories lost due to spoilage or expiry - P12,000 Depreciation on appraised value of property - P15,000 . Surcharge and compromise paid in relation to the late filing of ITR - P80,000 Contribution to a government for public purpose - P50,000 Contribution to Government's priority program in education - P10,500 Total quarterly income tax payments - P65,000 . Provision for bad debts - P8,000 Upload Choose a File Question 3 50 pts From the following data, 1) compute the income tax still due from Schrute University, a proprietary educational institution; and 2) classify each item whether it is a) permanent difference; b) taxable temporary difference; or c) deductible temporary difference. For the school year ended May 31, 2020, the net income per books (after tax) is P850,000, after considering among others: Interest income from bank deposit - P5,500 Inter-corporate dividends - P5,000 Gain from sale of shares in a domestic corporation - P7,000 Net capital loss - P2,500 . Bad debts written off - P6,500 Write-off of inventories lost due to spoilage or expiry - P12,000 Depreciation on appraised value of property - P15,000 . Surcharge and compromise paid in relation to the late filing of ITR - P80,000 Contribution to a government for public purpose - P50,000 Contribution to Government's priority program in education - P10,500 Total quarterly income tax payments - P65,000 . Provision for bad debts - P8,000 Upload Choose a File

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts