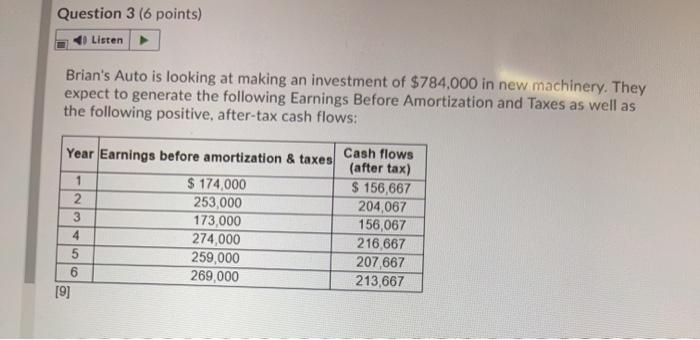

Question: Question 3 (6 points) Listen Brian's Auto is looking at making an investment of $784.000 in new machinery. They expect to generate the following Earnings

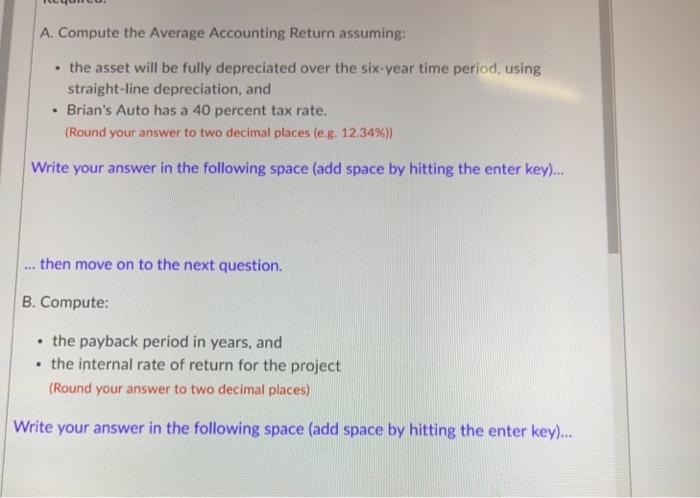

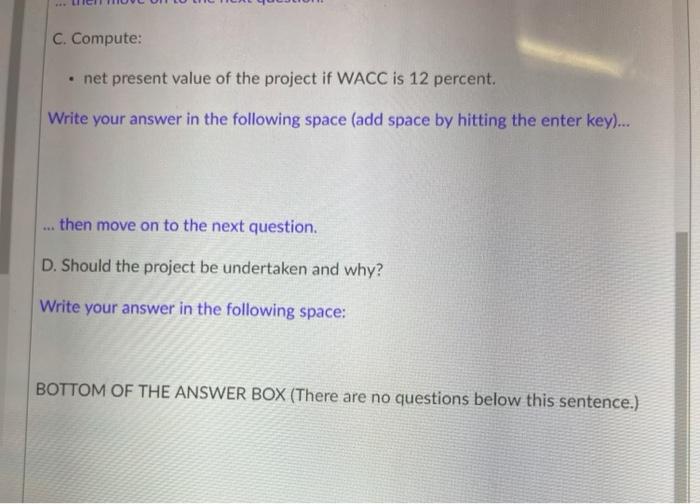

Question 3 (6 points) Listen Brian's Auto is looking at making an investment of $784.000 in new machinery. They expect to generate the following Earnings Before Amortization and Taxes as well as the following positive, after-tax cash flows: Year Earnings before amortization & taxes 1 $ 174,000 2 253,000 3 173,000 4 274,000 5 259,000 6 269,000 [9] Cash flows (after tax) $ 156,667 204,067 156,067 216,667 207,667 213,667 A. Compute the Average Accounting Return assuming: . the asset will be fully depreciated over the six-year time period, using straight-line depreciation, and Brian's Auto has a 40 percent tax rate. (Round your answer to two decimal places (e.g. 12.34%)) Write your answer in the following space (add space by hitting the enter key... then move on to the next question. B. Compute: the payback period in years, and the internal rate of return for the project (Round your answer to two decimal places) Write your answer in the following space (add space by hitting the enter key)... C. Compute: net present value of the project if WACC is 12 percent. Write your answer in the following space (add space by hitting the enter key... then move on to the next question. D. Should the project be undertaken and why? Write your answer in the following space: BOTTOM OF THE ANSWER BOX (There are no questions below this sentence.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts