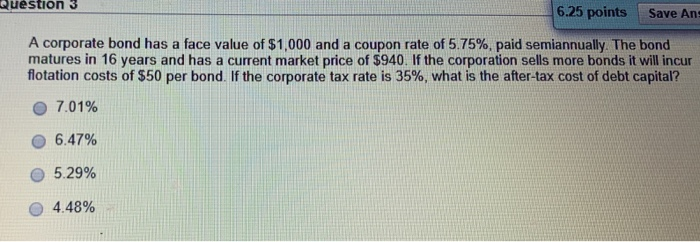

Question: Question 3 6.25 points Save An A corporate bond has a face value of $1,000 and a coupon rate of 5.75%, paid semiannually The bond

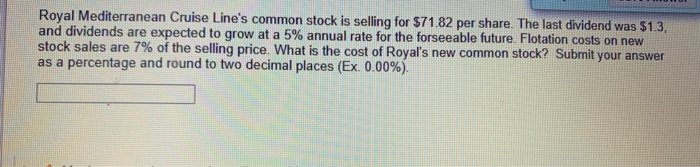

Question 3 6.25 points Save An A corporate bond has a face value of $1,000 and a coupon rate of 5.75%, paid semiannually The bond matures in 16 years and has a current market price of $940. If the corporation sells more bonds it will incur flotation costs of $50 per bond. If the corporate tax rate is 35%, what is the after-tax cost of debt capital? 7.01% 6.47% 5.29% 4.48% Royal Mediterranean Cruise Line's common stock is selling for $71.82 per share. The last dividend was $1.3, and dividends are expected to grow at a 5% annual rate for the forseeable future. Flotation costs on new stock sales are 7% of the selling price. What is the cost of Royal's new common stock? Submit your answer as a percentage and round to two decimal places (ex 0.00%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts