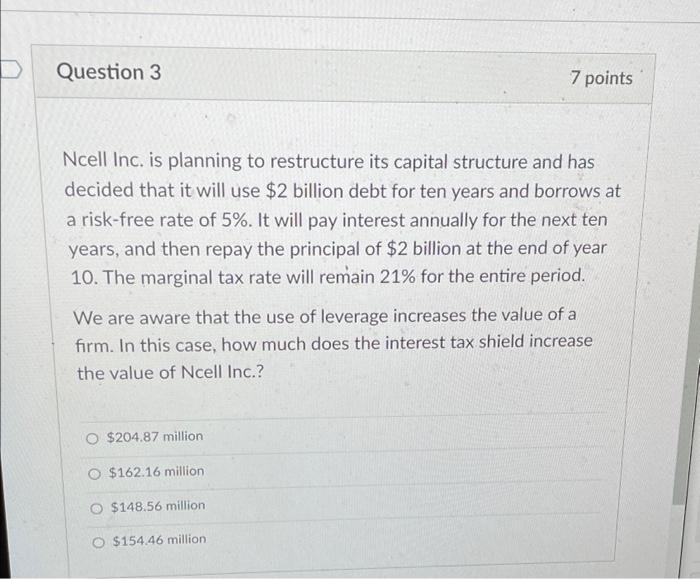

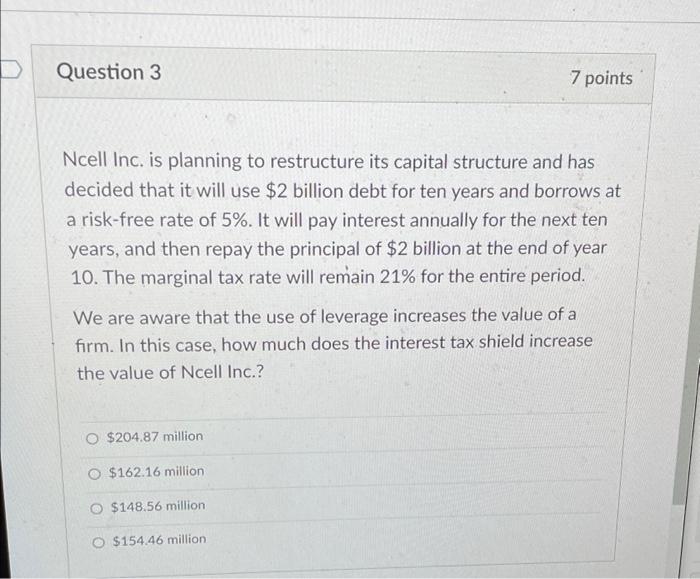

Question: Question 3 7 points Ncell Inc. is planning to restructure its capital structure and has decided that it will use $2 billion debt for ten

Question 3 7 points Ncell Inc. is planning to restructure its capital structure and has decided that it will use $2 billion debt for ten years and borrows at a risk-free rate of 5%. It will pay interest annually for the next ten years, and then repay the principal of $2 billion at the end of year 10. The marginal tax rate will remain 21% for the entire period. We are aware that the use of leverage increases the value of a firm. In this case, how much does the interest tax shield increase the value of Ncell Inc.? $204.87 million O $162.16 million $148.56 million O $154.46 million Question 3 7 points Ncell Inc. is planning to restructure its capital structure and has decided that it will use $2 billion debt for ten years and borrows at a risk-free rate of 5%. It will pay interest annually for the next ten years, and then repay the principal of $2 billion at the end of year 10. The marginal tax rate will remain 21% for the entire period. We are aware that the use of leverage increases the value of a firm. In this case, how much does the interest tax shield increase the value of Ncell Inc.? $204.87 million O $162.16 million $148.56 million O $154.46 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts