Question: Question 3 8 3 pts FACT PATTERN FOR TRAVIS AND TAYLOR: Travis, age 6 7 , and Taylor, age 6 6 , are married and

Question

pts

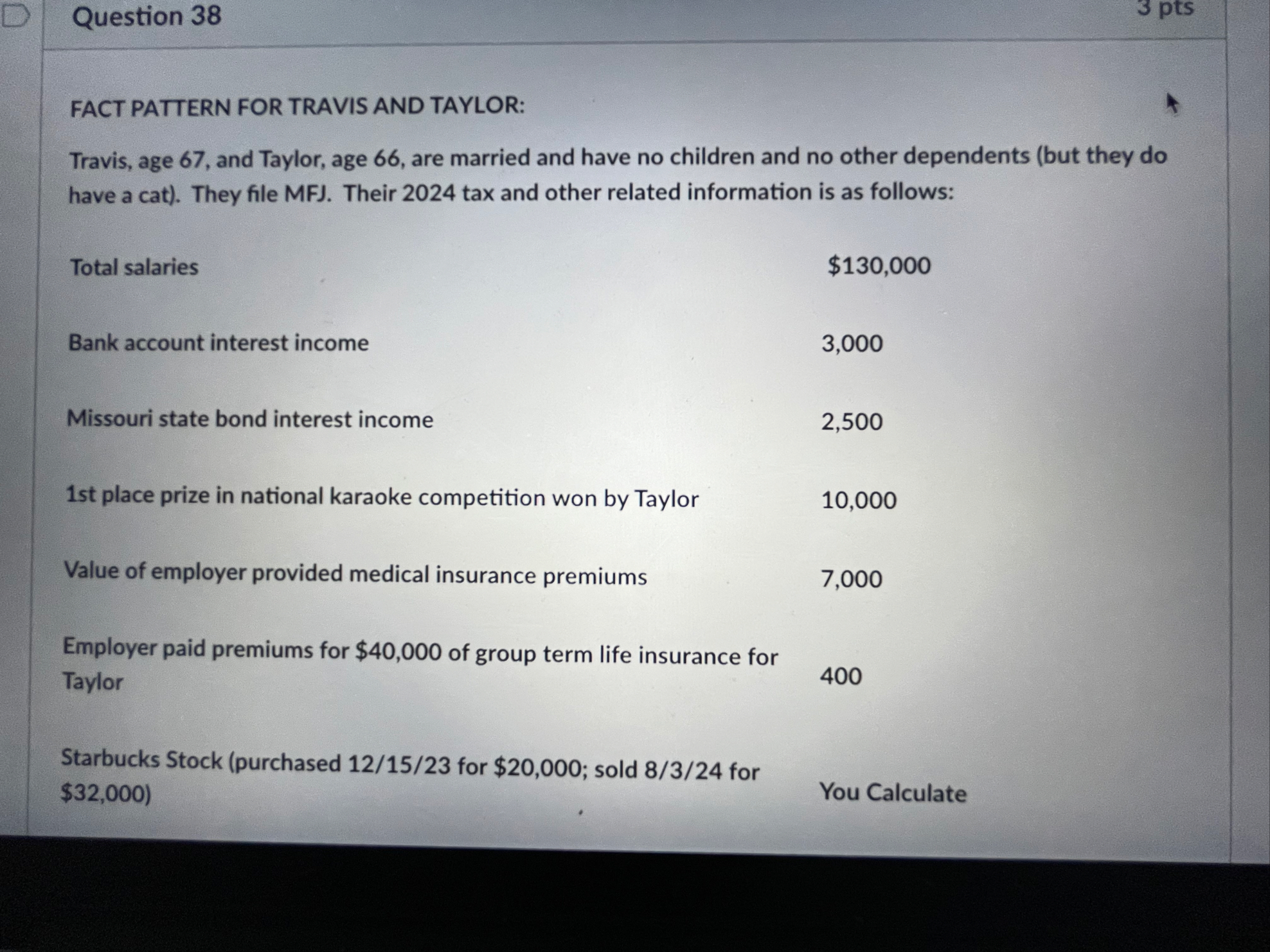

FACT PATTERN FOR TRAVIS AND TAYLOR:

Travis, age and Taylor, age are married and have no children and no other dependents but they do have a cat They file MFJ Their tax and other related information is as follows:

tableTotal salaries,$Bank account interest income,Missouri state bond interest income,st place prize in national karaoke competition won by Taylor,Value of employer provided medical insurance premiums,Employer paid premiums for $ of group term life insurance for Taylor,

Starbucks Stock purchased for $; sold for $

You Calculate

Starbucks Stock purchased for $; sold for $

You Calculate

Tesla Stock purchased for $; sold for $

You Calculate

Life Insurance proceeds received by Taylor, as beneficiary, on a policy owned by her aunt the insured when her aunt died

Dividend income from Samsung based in South Korea stock

Loan from Travis' parents

Gift from Taylor's parents

Interest on General Motors Bonds

Sale of qualified small business stock acquired by Travis on for a $ cash contribution. The stock was sold on

Alimony paid by Travis in as a result of his divorce in

Total itemized deductions for Travis and Taylor

Total Federal tax withholdings, estimated payments, and overpayment applied from the prior year return

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock