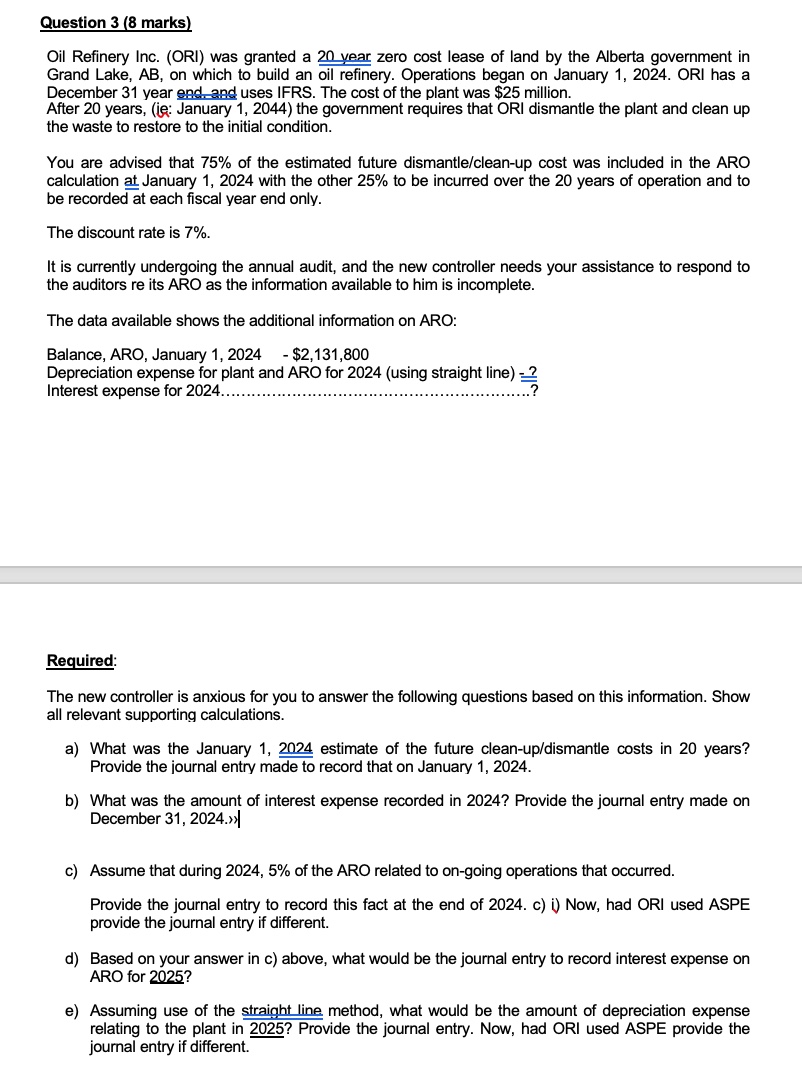

Question: Question 3 ( 8 marks ) Oil Refinery Inc. ( ORI ) was granted a 2 0 year zero cost lease of land by the

Question marks

Oil Refinery Inc. ORI was granted a year zero cost lease of land by the Alberta government in Grand Lake, AB on which to build an oil refinery. Operations began on January ORI has a December year end and uses IFRS. The cost of the plant was $ million.

After years, ie: January the government requires that ORI dismantle the plant and clean up the waste to restore to the initial condition.

You are advised that of the estimated future dismantlecleanup cost was included in the ARO calculation at January with the other to be incurred over the years of operation and to be recorded at each fiscal year end only.

The discount rate is

It is currently undergoing the annual audit, and the new controller needs your assistance to respond to the auditors re its ARO as the information available to him is incomplete.

The data available shows the additional information on ARO:

Balance, ARO, January $

Depreciation expense for plant and ARO for using straight line

Interest expense for

Required:

The new controller is anxious for you to answer the following questions based on this information. Show all relevant supporting calculations.

a What was the January estimate of the future cleanupdismantle costs in years? Provide the journal entry made to record that on January

b What was the amount of interest expense recorded in Provide the journal entry made on December

c Assume that during of the ARO related to ongoing operations that occurred.

Provide the journal entry to record this fact at the end of c i Now, had ORI used ASPE provide the journal entry if different.

d Based on your answer in c above, what would be the journal entry to record interest expense on ARO for

e Assuming use of the straight line method, what would be the amount of depreciation expense relating to the plant in Provide the journal entry. Now, had ORI used ASPE provide the journal entry if different.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock