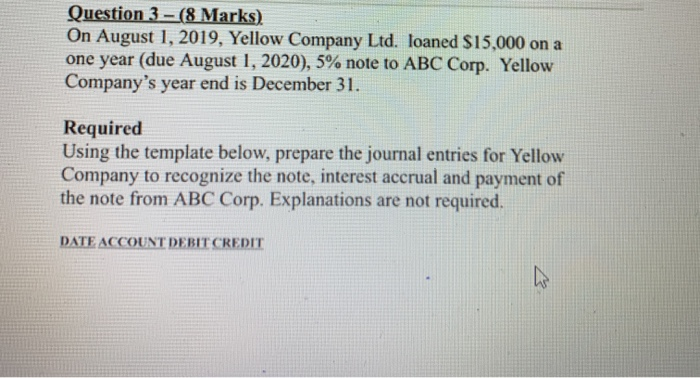

Question: Question 3 - (8 Marks) On August 1, 2019, Yellow Company Ltd. loaned $15,000 on a one year (due August 1, 2020), 5% note to

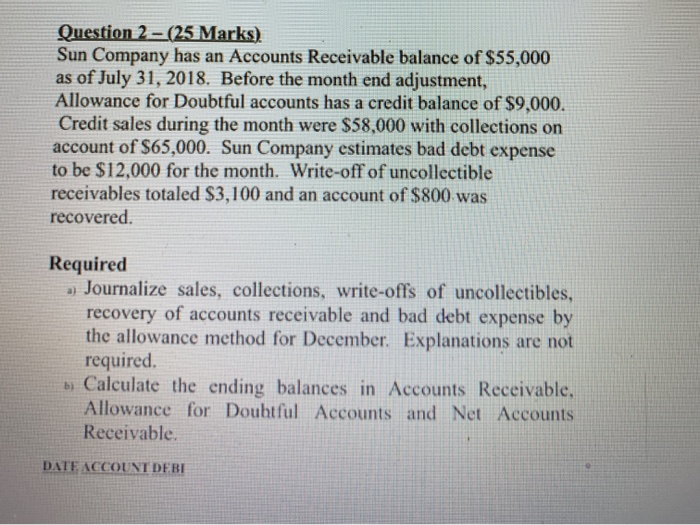

Question 3 - (8 Marks) On August 1, 2019, Yellow Company Ltd. loaned $15,000 on a one year (due August 1, 2020), 5% note to ABC Corp. Yellow Company's year end is December 31. Required Using the template below, prepare the journal entries for Yellow Company to recognize the note, interest accrual and payment of the note from ABC Corp. Explanations are not required. DATE ACCOUNT DEBIT CREDIT Question 2 - (25 Marks) Sun Company has an Accounts Receivable balance of $55,000 as of July 31, 2018. Before the month end adjustment, Allowance for Doubtful accounts has a credit balance of $9,000. Credit sales during the month were $58,000 with collections on account of $65,000. Sun Company estimates bad debt expense to be $12,000 for the month. Write-off of uncollectible receivables totaled $3,100 and an account of $800 was recovered. Required a) Journalize sales, collections, write-offs of uncollectibles, recovery of accounts receivable and bad debt expense by the allowance method for December. Explanations are not required - Calculate the ending balances in Accounts Receivable, Allowance for Doubtful Accounts and Net Accounts Receivable. DATE ACCOUNT DEBI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts