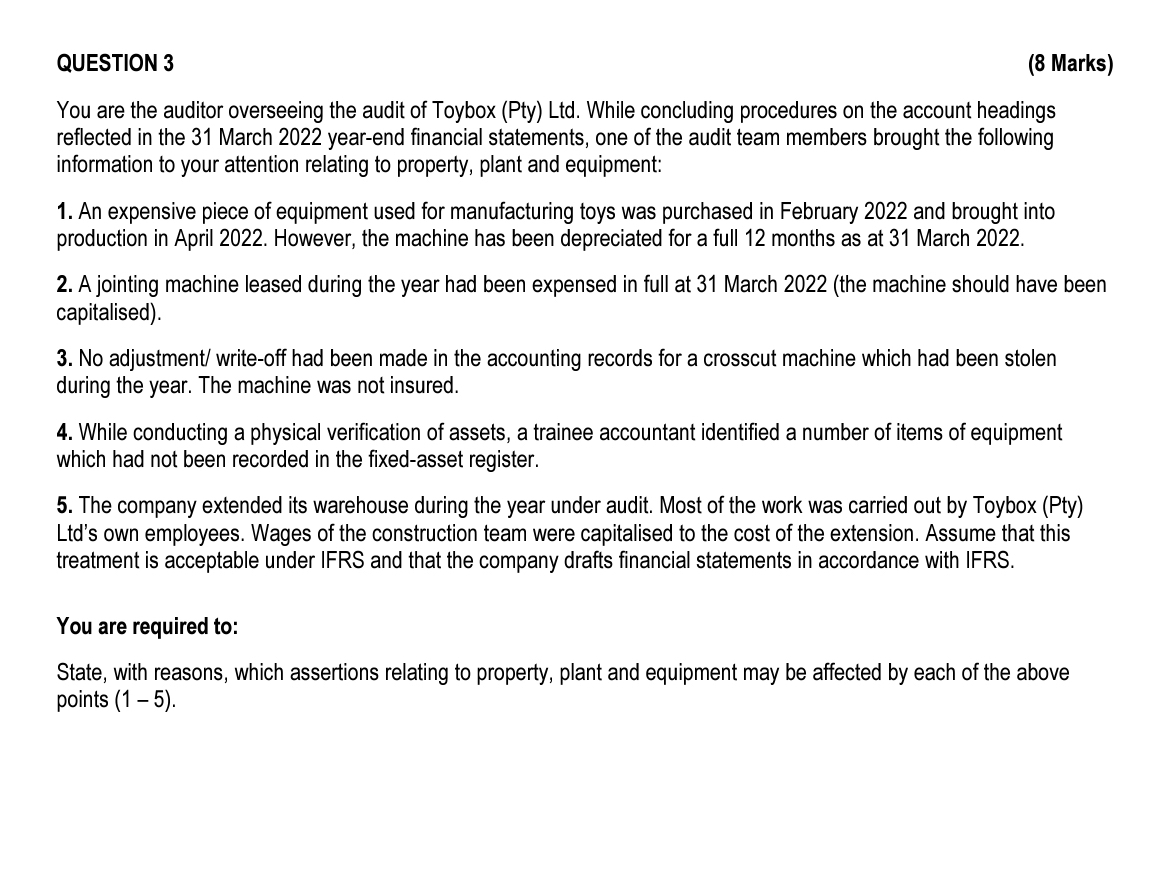

Question: QUESTION 3 ( 8 Marks ) You are the auditor overseeing the audit of Toybox ( Pty ) Ltd . While concluding procedures on the

QUESTION

Marks

You are the auditor overseeing the audit of Toybox Pty Ltd While concluding procedures on the account headings reflected in the March yearend financial statements, one of the audit team members brought the following information to your attention relating to property, plant and equipment:

An expensive piece of equipment used for manufacturing toys was purchased in February and brought into production in April However, the machine has been depreciated for a full months as at March

A jointing machine leased during the year had been expensed in full at March the machine should have been capitalised

No adjustment writeoff had been made in the accounting records for a crosscut machine which had been stolen during the year. The machine was not insured.

While conducting a physical verification of assets, a trainee accountant identified a number of items of equipment which had not been recorded in the fixedasset register.

The company extended its warehouse during the year under audit. Most of the work was carried out by Toybox Pty Ltds own employees. Wages of the construction team were capitalised to the cost of the extension. Assume that this treatment is acceptable under IFRS and that the company drafts financial statements in accordance with IFRS.

You are required to:

State, with reasons, which assertions relating to property, plant and equipment may be affected by each of the above points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock