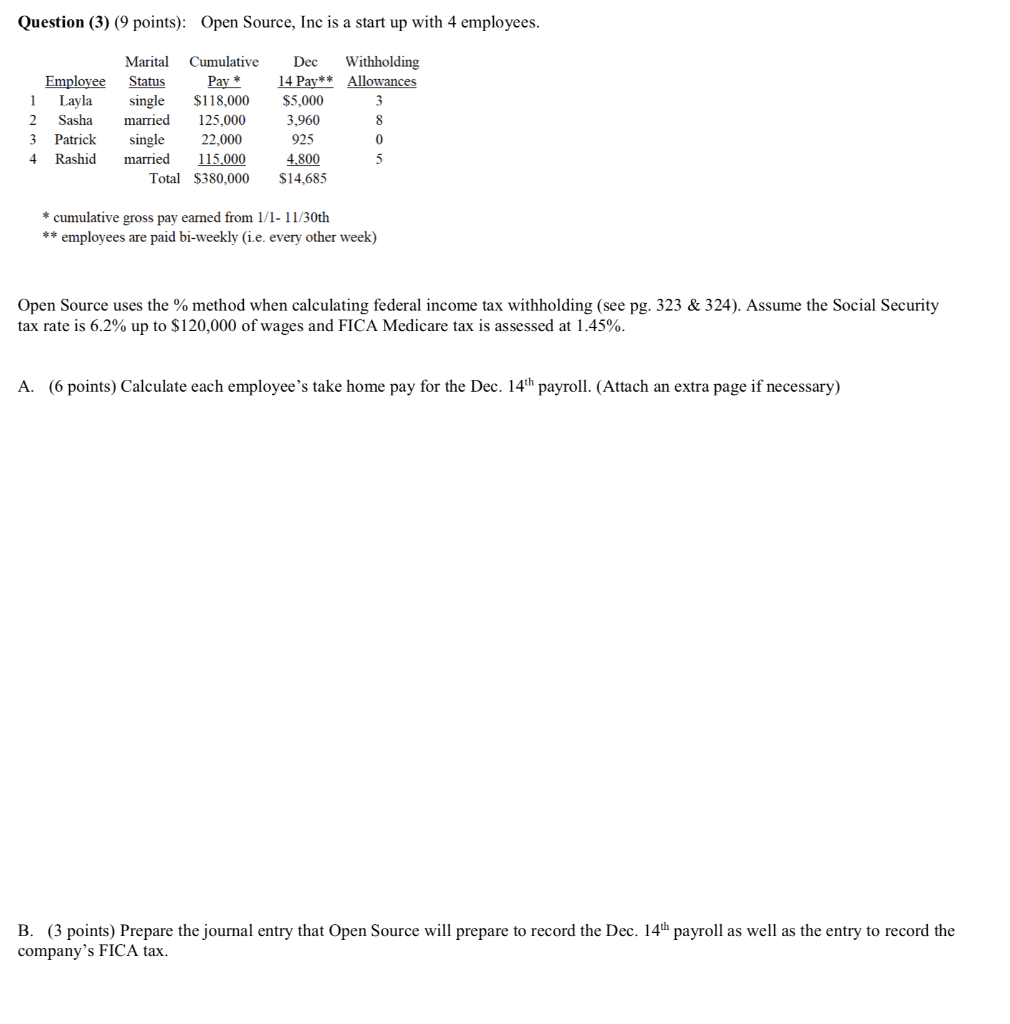

Question: Question (3) (9 points): Open Source, Inc is a start up with 4 employees Marital Cumulative Dec Withholding Emplovee Status Pay14Pay*Allowances 1Layla 2 Sasha married

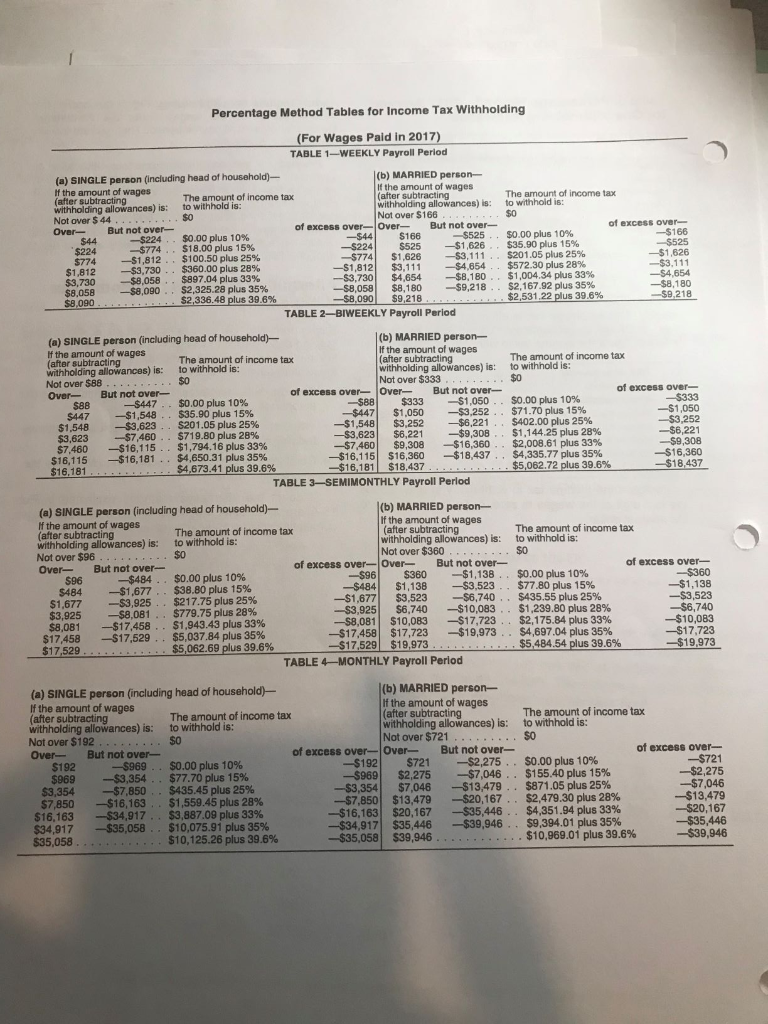

Question (3) (9 points): Open Source, Inc is a start up with 4 employees Marital Cumulative Dec Withholding Emplovee Status Pay14Pay*Allowances 1Layla 2 Sasha married 125,000 3 Patrick single 22,000 4 Rashid maried 115,000 single $118,000 $5,000 3,960 925 4,800 Total $380,000 $14,685 gross pay earned from 1/1- 11/30th *cumulative employees are paid bi-weekly (i.e every other week) Open Source uses the % method when calculating federal income tax withholding (see pg. 323 & 324). Assume the Social Security tax rate is 6.2% up to $120,000 of wages and FICA Medicare tax is assessed at 1.45% (6 points) Calculate each employee's take home pay for the Dec. 14th payroll. (Attach an extra page if necessary) A. B. (3 points) Prepare the journal entry that Open Source will prepare to record the Dec. 14th payroll as well as the entry to record the company's FICA tax. Percentage Method Tables for Income Tax Withholding For Wages Pald in 2017) TABLE 1-WEEKLY Payroll Period (b) MARRIED person (a) SINGLE person (including head of household)- The amount of income tax withholding allowances) is: to withhold is: to withhold is: withholding allowances) is: $0 $o of excess over-OverBut not over- $0.00 plus 10% $35.90 plus 15% $201.05 plus 25% $572.30 plus 28% $1,004.34 plus 33% $2,167.92 plus 35% $2,531pl 39.6% -5525 . . --$1,626. -5224 , $0.00 plus 10% -5774 . $18.00 plus 15% -5224| -5774 | $1,812| --$3,730| -$8,058| S525 $1,626-63,1 1 1 $774 --$1,812 . . S100.50 plus 25% $1,812-53,730 . . $360.00 plus 28% $3.730-$8,058., $897.04 plus 33% $8,058 --$8,090 $2.325.28 plus 35% . $3,1 1 1-$4,654 . $4,654-$8,180 . . $8,180-59,218.. $2,336.48 plus 39.6% - TABLE 2-BIWEEKLY Payroll Period (a) SINGLE person (ncluding head of household- The amount of income tax The amount of income tax $0 $0 $333-61.050.. SO.00 plus 10% $1,050-$3.252.. $71.70 plus 15% $3,252 --$6,221. $402.00 plus 25% $6,221-59.308.. S1,1 44.25 plus 28% $9.308-$16.360.. $16,360-$18,437.. $0.00 plus 10% $35.90 plus 15% -588| -4447 -51,548| -$3,623| 7,460 --$16,115| --$447 . . $447-$1,548.. S88 $719.80 plus 28% $1,794.16 plus 33% $4,650.31 plus 35% $4,673.41 plus 39.6% $3,623 --$7,460.. $7,460-516,115.. $16,115-$16,181 . . $2,008.61 plus 33% $4,335.77 plus 35% $5,062.72 plus 39.6% TABLE 3-SEMIMONTHLY Payroll Period (b) MARRIED person- If the amount of wages (a) SINGLE person (including head of household)- If the amount of wages The amount of income tax The amount of income tax to withhold is: $0 withholding allowances) is: to withhold is: $0 withholding allowances) is: of excess over-Over-But not over- S360-$1,138 ..SO,00 plus 10% $1,138-53523 . . $77.80 plus 15% $3.523-$6,740.. $435.55 plus 25% S6.740-$10,083,-$1,239.80 plus 28% $10,083 -SI 7,723.. $2,175.84 plus 33% $17,723 --$19,973.. S4,697.04 plus 35% -$96| -$484| -51,677| -$3.925 -58,081| --$17,458| $0.00 plus 10% $38.80 plus 15% $217.75 plus 25% $779.75 plus 28% $1,943.43 plus 33% $5,037.84 plus 35% $5,062.69 plus 39.6% -$484.. $484-51,677,- $1,677-$3.925.. $3,925-58,081 . . $8,081 --$17,458 . . $17,458-517,529 . . $96 $5,484.54 plus 39.6% S17.529 $19,973 TABLE 4-MONTHLY Payroll Period (b) MARRIED p If the amount of wages (a) SINGLE person (including head of household The amount of income tax The amount of income to withhold is: So withholding allowances) is: withholding allowances) is: to wme tax s0 But not over- S721-52,275 . . $2.275-$7,046 .. $7,046-513,479.. $13,479-520.167.. $20.167-535,446, s35446-539,946 . . of excess over-Over S0.00 plus 10% $155.40 plus 15% $871.05 plus 25% $2.479.30 plus 28% $4,351.94 plus 33% se,394.01 plus 35% $10,969.01 plus 39.6% -5192| -5969| -$3,354| -$7,850| -$16,163| -534,917| -5969- . $0.00 plus 10% $969 --$3,354 . . $77.70 plus 15% $3.354-57,850 ,-$435.45 plus 25% $7,850 --$16,163 . . SI ,559.45 plus 28% $16,163-534,917.. $3.887.09 plus 33% $34,917 --$35,058 . . $10,075.91 plus 35% $10,1 25.26 plus 39.6% Question (3) (9 points): Open Source, Inc is a start up with 4 employees Marital Cumulative Dec Withholding Emplovee Status Pay14Pay*Allowances 1Layla 2 Sasha married 125,000 3 Patrick single 22,000 4 Rashid maried 115,000 single $118,000 $5,000 3,960 925 4,800 Total $380,000 $14,685 gross pay earned from 1/1- 11/30th *cumulative employees are paid bi-weekly (i.e every other week) Open Source uses the % method when calculating federal income tax withholding (see pg. 323 & 324). Assume the Social Security tax rate is 6.2% up to $120,000 of wages and FICA Medicare tax is assessed at 1.45% (6 points) Calculate each employee's take home pay for the Dec. 14th payroll. (Attach an extra page if necessary) A. B. (3 points) Prepare the journal entry that Open Source will prepare to record the Dec. 14th payroll as well as the entry to record the company's FICA tax. Percentage Method Tables for Income Tax Withholding For Wages Pald in 2017) TABLE 1-WEEKLY Payroll Period (b) MARRIED person (a) SINGLE person (including head of household)- The amount of income tax withholding allowances) is: to withhold is: to withhold is: withholding allowances) is: $0 $o of excess over-OverBut not over- $0.00 plus 10% $35.90 plus 15% $201.05 plus 25% $572.30 plus 28% $1,004.34 plus 33% $2,167.92 plus 35% $2,531pl 39.6% -5525 . . --$1,626. -5224 , $0.00 plus 10% -5774 . $18.00 plus 15% -5224| -5774 | $1,812| --$3,730| -$8,058| S525 $1,626-63,1 1 1 $774 --$1,812 . . S100.50 plus 25% $1,812-53,730 . . $360.00 plus 28% $3.730-$8,058., $897.04 plus 33% $8,058 --$8,090 $2.325.28 plus 35% . $3,1 1 1-$4,654 . $4,654-$8,180 . . $8,180-59,218.. $2,336.48 plus 39.6% - TABLE 2-BIWEEKLY Payroll Period (a) SINGLE person (ncluding head of household- The amount of income tax The amount of income tax $0 $0 $333-61.050.. SO.00 plus 10% $1,050-$3.252.. $71.70 plus 15% $3,252 --$6,221. $402.00 plus 25% $6,221-59.308.. S1,1 44.25 plus 28% $9.308-$16.360.. $16,360-$18,437.. $0.00 plus 10% $35.90 plus 15% -588| -4447 -51,548| -$3,623| 7,460 --$16,115| --$447 . . $447-$1,548.. S88 $719.80 plus 28% $1,794.16 plus 33% $4,650.31 plus 35% $4,673.41 plus 39.6% $3,623 --$7,460.. $7,460-516,115.. $16,115-$16,181 . . $2,008.61 plus 33% $4,335.77 plus 35% $5,062.72 plus 39.6% TABLE 3-SEMIMONTHLY Payroll Period (b) MARRIED person- If the amount of wages (a) SINGLE person (including head of household)- If the amount of wages The amount of income tax The amount of income tax to withhold is: $0 withholding allowances) is: to withhold is: $0 withholding allowances) is: of excess over-Over-But not over- S360-$1,138 ..SO,00 plus 10% $1,138-53523 . . $77.80 plus 15% $3.523-$6,740.. $435.55 plus 25% S6.740-$10,083,-$1,239.80 plus 28% $10,083 -SI 7,723.. $2,175.84 plus 33% $17,723 --$19,973.. S4,697.04 plus 35% -$96| -$484| -51,677| -$3.925 -58,081| --$17,458| $0.00 plus 10% $38.80 plus 15% $217.75 plus 25% $779.75 plus 28% $1,943.43 plus 33% $5,037.84 plus 35% $5,062.69 plus 39.6% -$484.. $484-51,677,- $1,677-$3.925.. $3,925-58,081 . . $8,081 --$17,458 . . $17,458-517,529 . . $96 $5,484.54 plus 39.6% S17.529 $19,973 TABLE 4-MONTHLY Payroll Period (b) MARRIED p If the amount of wages (a) SINGLE person (including head of household The amount of income tax The amount of income to withhold is: So withholding allowances) is: withholding allowances) is: to wme tax s0 But not over- S721-52,275 . . $2.275-$7,046 .. $7,046-513,479.. $13,479-520.167.. $20.167-535,446, s35446-539,946 . . of excess over-Over S0.00 plus 10% $155.40 plus 15% $871.05 plus 25% $2.479.30 plus 28% $4,351.94 plus 33% se,394.01 plus 35% $10,969.01 plus 39.6% -5192| -5969| -$3,354| -$7,850| -$16,163| -534,917| -5969- . $0.00 plus 10% $969 --$3,354 . . $77.70 plus 15% $3.354-57,850 ,-$435.45 plus 25% $7,850 --$16,163 . . SI ,559.45 plus 28% $16,163-534,917.. $3.887.09 plus 33% $34,917 --$35,058 . . $10,075.91 plus 35% $10,1 25.26 plus 39.6%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts