Question: Question 3 9 Why do spreads on leveraged loans behave more like investment - grade bonds than like high - yield bonds? They tend to

Question

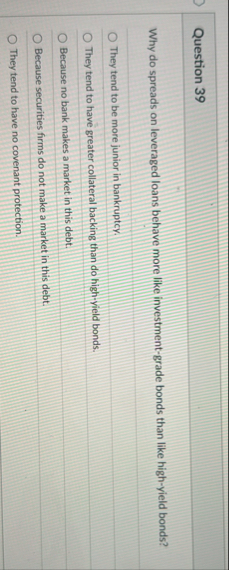

Why do spreads on leveraged loans behave more like investmentgrade bonds than like highyield bonds?

They tend to be more junior in bankruptcy.

They tend to have greater collateral backing than do highyield bonds.

Because no bank makes a market in this debt.

Because securities firms do not make a market in this debt.

They tend to have no covenant protection.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock