Question: Question 3 (a) A perpetuity-due starts the first payment one year later. During the first 10 years, the annual payment remains at $300 and then

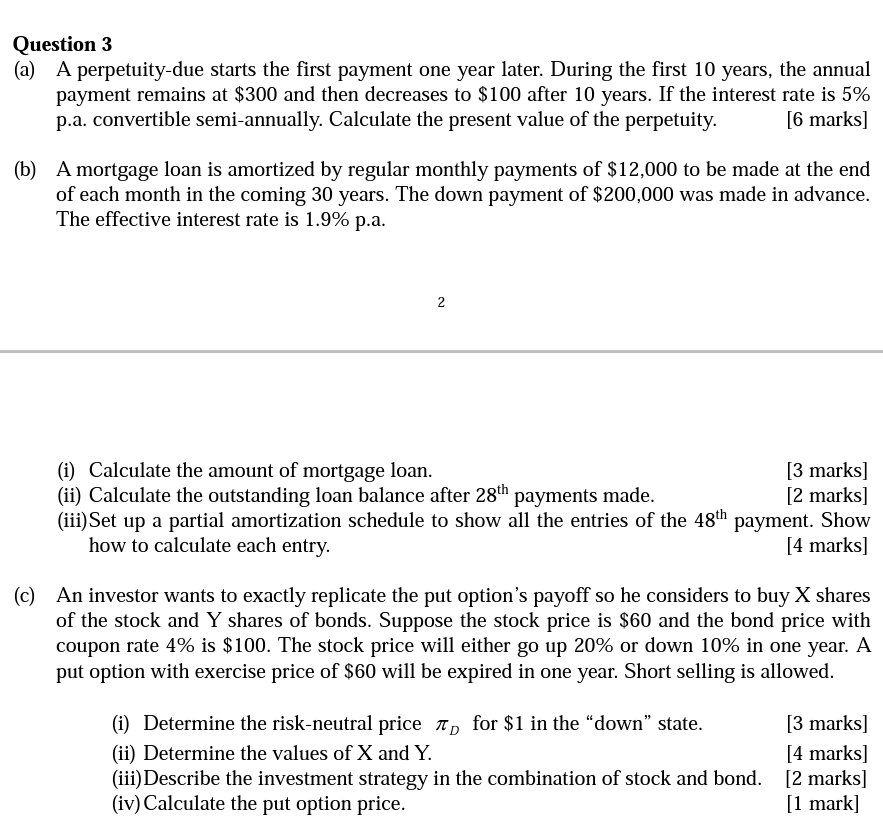

Question 3 (a) A perpetuity-due starts the first payment one year later. During the first 10 years, the annual payment remains at $300 and then decreases to $100 after 10 years. If the interest rate is 5% p.a. convertible semi-annually. Calculate the present value of the perpetuity. [6 marks] (b) A mortgage loan is amortized by regular monthly payments of $12,000 to be made at the end of each month in the coming 30 years. The down payment of $200,000 was made in advance. The effective interest rate is 1.9% p.a (i) Calculate the amount of mortgage loan (ii) Calculate the outstanding loan balance after 28th payments made (iii)Set up a partial amortization schedule to show all the entries of the 48th payment. Show [3 marks] [2 marks] how to calculate each entry [4 marks] (c) An investor wants to exactly replicate the put option's payoff so he considers to buy X shares of the stock and Y shares of bonds. Suppose the stock price is $60 and the bond price with coupon rate 490 is $100. The stock price will either go up 20% or down 10% in one year. A put option with exercise price of $60 will be expired in one year. Short selling is allowed. (i) Determine the risk-neutral price Tp for $1 in the "down" state (ii) Determine the values of X and Y. (iii) Describe the investment strategy in the combination of stock and bond. (iv) Calculate the put option price [3 marks] [4 marks] [2 marks] [1 mark] Question 3 (a) A perpetuity-due starts the first payment one year later. During the first 10 years, the annual payment remains at $300 and then decreases to $100 after 10 years. If the interest rate is 5% p.a. convertible semi-annually. Calculate the present value of the perpetuity. [6 marks] (b) A mortgage loan is amortized by regular monthly payments of $12,000 to be made at the end of each month in the coming 30 years. The down payment of $200,000 was made in advance. The effective interest rate is 1.9% p.a (i) Calculate the amount of mortgage loan (ii) Calculate the outstanding loan balance after 28th payments made (iii)Set up a partial amortization schedule to show all the entries of the 48th payment. Show [3 marks] [2 marks] how to calculate each entry [4 marks] (c) An investor wants to exactly replicate the put option's payoff so he considers to buy X shares of the stock and Y shares of bonds. Suppose the stock price is $60 and the bond price with coupon rate 490 is $100. The stock price will either go up 20% or down 10% in one year. A put option with exercise price of $60 will be expired in one year. Short selling is allowed. (i) Determine the risk-neutral price Tp for $1 in the "down" state (ii) Determine the values of X and Y. (iii) Describe the investment strategy in the combination of stock and bond. (iv) Calculate the put option price [3 marks] [4 marks] [2 marks] [1 mark]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts