Question: Question 3 (a) Calculate the 2-year spot rate implied by the US Treasury yield curve data based on two zero coupon US Treasury bonds of

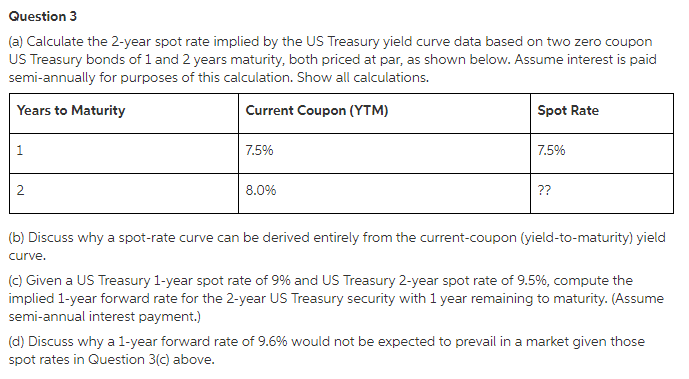

Question 3 (a) Calculate the 2-year spot rate implied by the US Treasury yield curve data based on two zero coupon US Treasury bonds of 1 and 2 years maturity, both priced at par, as shown below. Assume interest is paid semi-annually for purposes of this calculation. Show all calculations. Years to Maturity Current Coupon (YTM) Spot Rate 7.5% 75% 8.0% (b) Discuss why a spot-rate curve can be derived entirely from the current-coupon (yield-to-maturity) yield curve (c) Given a US Treasury 1-year spot rate of 996 and US Treasury 2-year spot rate of 9.5%, compute the implied 1-year forward rate for the 2-year US Treasury security with 1 year remaining to maturity. (Assume semi-annual interest payment.) (d) Discuss why a 1-year forward rate of 9.6% would not be expected to prevail in a market given those spot rates in Question 3(c) above. Question 3 (a) Calculate the 2-year spot rate implied by the US Treasury yield curve data based on two zero coupon US Treasury bonds of 1 and 2 years maturity, both priced at par, as shown below. Assume interest is paid semi-annually for purposes of this calculation. Show all calculations. Years to Maturity Current Coupon (YTM) Spot Rate 7.5% 75% 8.0% (b) Discuss why a spot-rate curve can be derived entirely from the current-coupon (yield-to-maturity) yield curve (c) Given a US Treasury 1-year spot rate of 996 and US Treasury 2-year spot rate of 9.5%, compute the implied 1-year forward rate for the 2-year US Treasury security with 1 year remaining to maturity. (Assume semi-annual interest payment.) (d) Discuss why a 1-year forward rate of 9.6% would not be expected to prevail in a market given those spot rates in Question 3(c) above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts