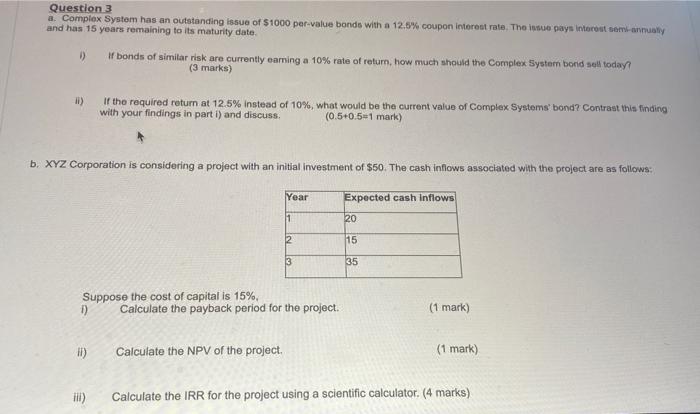

Question: Question 3 a Complex System has an outstanding issue of $1000 per-value bands with a 12.8% coupon interest rate. The we pays Intorout semi-annually and

Question 3 a Complex System has an outstanding issue of $1000 per-value bands with a 12.8% coupon interest rate. The we pays Intorout semi-annually and has 15 years remaining to its maturity date D bonds of similar risk are currently caring a 10% rate of return, how much should the Complex System bond sell today? (3 marks) 1) if the required return at 12.5% instead of 10%, what would be the current value of Complex Systems' bond? Contrast this finding with your findings in parti) and discuss. (0.5+0.5-1 mark) b. XYZ Corporation is considering a project with an initial investment of $50. The cash inflows associated with the project are as follows: Year Expected cash inflows 1 20 2 IN 115 3 35 Suppose the cost of capital is 15%, Calculate the payback period for the project. (1 mark) it) Calculate the NPV of the project (1 mark) III) Calculate the IRR for the project using a scientific calculator. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts