Question: Question 3 a) Consider a situation in which a manufacturing affiliate is selling to a distribution affiliate in another country. The relevant tax information, operating

Question 3

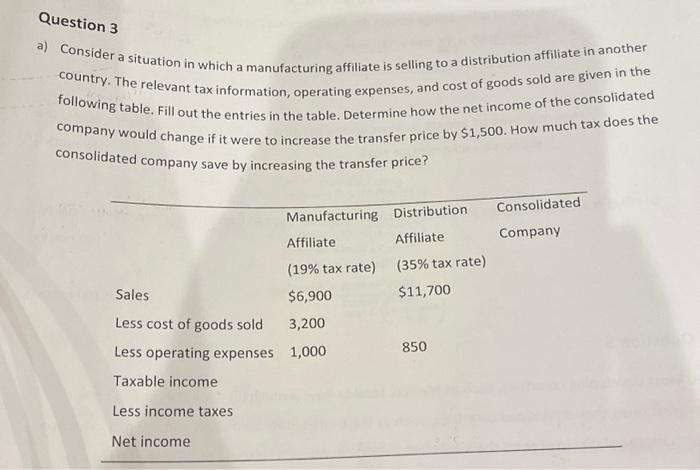

a) Consider a situation in which a manufacturing affiliate is selling to a distribution affiliate in another country. The relevant tax information, operating expenses, and cost of goods sold are given in the following table. Fill out the entries in the table. Determine how the net income of the consolidated company would change if it were to increase the transfer price by $1,500. How much tax does the consolidated company save by increasing the transfer price?

Question 3 a) Consider a situation in which a manufacturing affiliate is selling to a distribution affiliate in another country. The relevant tax information, operating expenses, and cost of goods sold are given in the following table. Fill out the entries in the table. Determine how the net income of the consolidated company would change if it were to increase the transfer price by $1,500. How much tax does the consolidated company save by increasing the transfer price

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock