Question: A construction fim CK Associates started operations on 31 December 2018 by issuing 2.8 million shares of 1 each, and acquiring 150,000 worth of

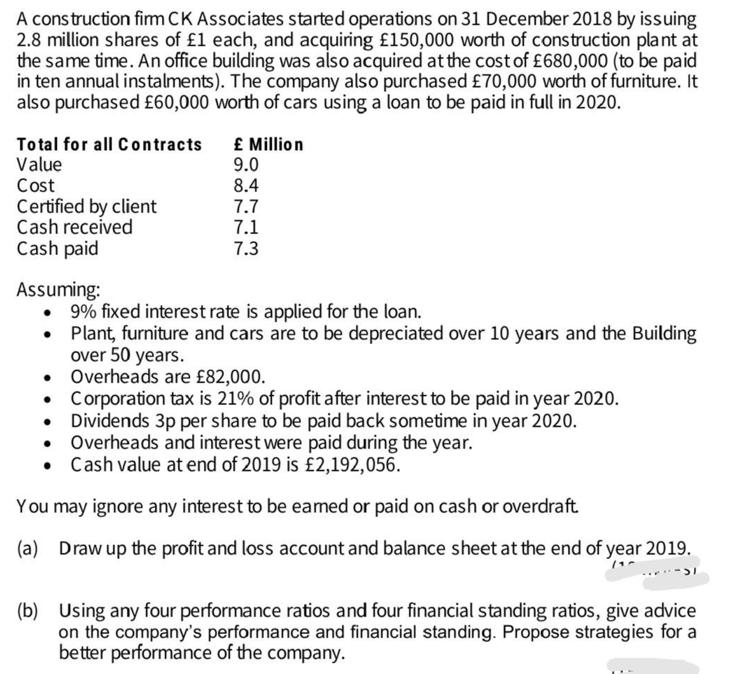

A construction fim CK Associates started operations on 31 December 2018 by issuing 2.8 million shares of 1 each, and acquiring 150,000 worth of construction plant at the same time. An office building was also acquired at the cost of 680,000 (to be paid in ten annual instalments). The company also purchased 70,000 worth of furniture. It also purchased 60,000 worth of cars using a loan to be paid in full in 2020. Million 9.0 8.4 7.7 7.1 7.3 Total for all Contracts Value Cost Certified by client Cash received Cash paid Assuming: 9% fixed interest rate is applied for the loan. Plant, furniture and cars are to be depreciated over 10 years and the Building over 50 years. Overheads are 82,000. Corporation tax is 21% of profit after interest to be paid in year 2020. Dividends 3p per share to be paid back sometime in year 2020. Overheads and interest were paid during the year. Cash value at end of 2019 is 2,192,056. You may ignore any interest to be eamed or paid on cash or overdraft. (a) Draw up the profit and loss account and balance sheet at the end of year 2019. (b) Using any four performance ratios and four financial standing ratios, give advice on the company's performance and financial standing. Propose strategies for a better performance of the company.

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step 1 financial statement we have a ten... View full answer

Get step-by-step solutions from verified subject matter experts