Question: Question 3: A Corporation is owned by two shareholders, A and B, each holding 50% of the equity shares. The marginal personal income tax rate

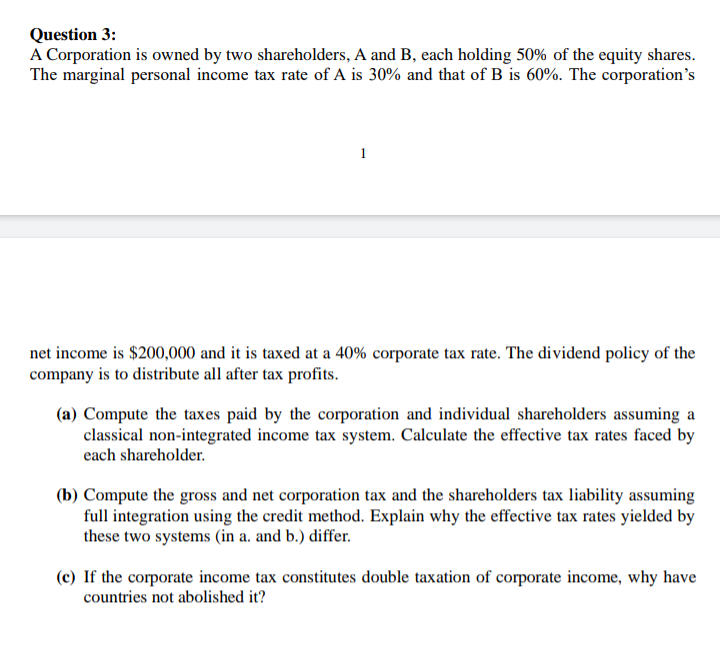

Question 3: A Corporation is owned by two shareholders, A and B, each holding 50% of the equity shares. The marginal personal income tax rate of A is 30% and that of B is 60%. The corporation's net income is $200,000 and it is taxed at a 40% corporate tax rate. The dividend policy of the company is to distribute all after tax profits. (a) Compute the taxes paid by the corporation and individual shareholders assuming a classical non-integrated income tax system. Calculate the effective tax rates faced by each shareholder (b) Compute the gross and net corporation tax and the shareholders tax liability assuming full integration using the credit method. Explain why the effective tax rates yielded by these two systems (in a. and b.) differ. (e) If the corporate income tax constitutes double taxation of corporate income, why have countries not abolished it

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts