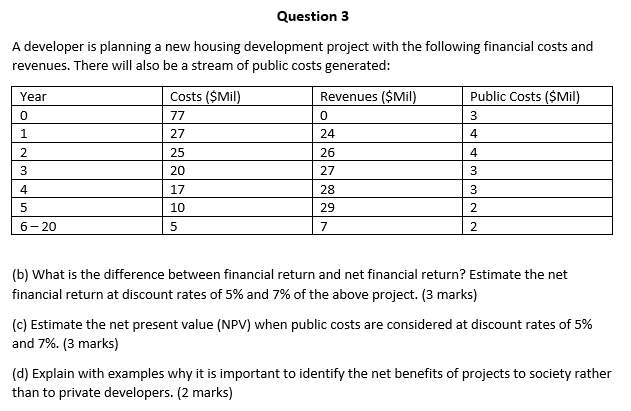

Question: Question 3 A developer is planning a new housing development project with the following financial costs and revenues. There will also be a stream of

Question 3 A developer is planning a new housing development project with the following financial costs and revenues. There will also be a stream of public costs generated: Year Costs ($Mil) Revenues ($Mil) Public Costs ($Mil) 0 77 0 3 27 24 2 25 26 4 3 20 27 3 4 rn 3 17 10 28 29 2 6-20 5 7 2 (b) What is the difference between financial return and net financial return? Estimate the net financial return at discount rates of 5% and 7% of the above project. (3 marks) (c) Estimate the net present value (NPV) when public costs are considered at discount rates of 5% and 7%. (3 marks) (d) Explain with examples why it is important to identify the net benefits of projects to society rather than to private developers. (2 marks) Question 3 A developer is planning a new housing development project with the following financial costs and revenues. There will also be a stream of public costs generated: Year Costs ($Mil) Revenues ($Mil) Public Costs ($Mil) 0 77 0 3 27 24 2 25 26 4 3 20 27 3 4 rn 3 17 10 28 29 2 6-20 5 7 2 (b) What is the difference between financial return and net financial return? Estimate the net financial return at discount rates of 5% and 7% of the above project. (3 marks) (c) Estimate the net present value (NPV) when public costs are considered at discount rates of 5% and 7%. (3 marks) (d) Explain with examples why it is important to identify the net benefits of projects to society rather than to private developers. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts