Question: Question 3 (a.) Estimating a single index model with four observations has revealed the following results: [ R_{i t}=2.473+1.011 R_{m t}+varepsilon_{i t} ] The four

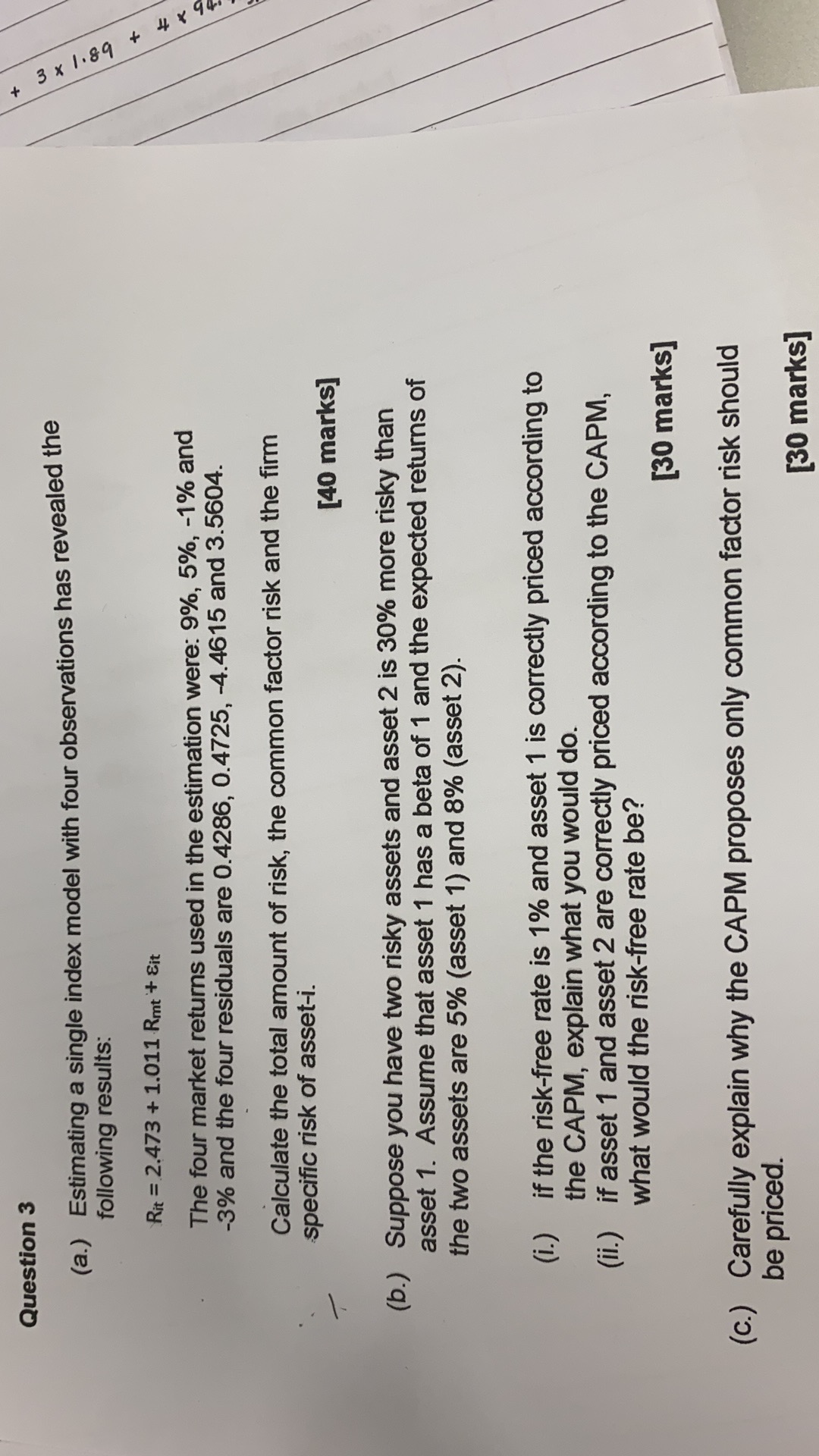

Question 3 (a.) Estimating a single index model with four observations has revealed the following results: \\[ R_{i t}=2.473+1.011 R_{m t}+\\varepsilon_{i t} \\] The four market returns used in the estimation were: \9 and \3 and the four residuals are \\( 0.4286,0.4725,-4.4615 \\) and 3.5604 . Calculate the total amount of risk, the common factor risk and the firm specific risk of asset-i. [40 marks] (b.) Suppose you have two risky assets and asset 2 is \30 more risky than asset 1. Assume that asset 1 has a beta of 1 and the expected returns of the two assets are \5 (asset 1 ) and \8 (asset 2). (i.) if the risk-free rate is \1 and asset 1 is correctly priced according to the CAPM, explain what you would do. (ii.) if asset 1 and asset 2 are correctly priced according to the CAPM, what would the risk-free rate be? [30 marks] (c.) Carefully explain why the CAPM proposes only common factor risk should be priced. [30 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts