Question: Question 3 A. Explain why an option's time value is greatest when the stock price is near the exercise price and why it nearly disappears

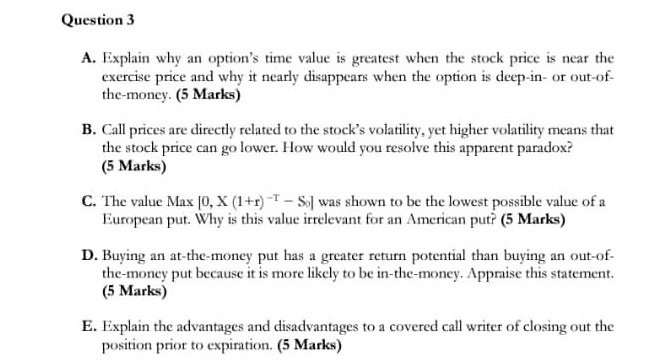

Question 3 A. Explain why an option's time value is greatest when the stock price is near the exercise price and why it nearly disappears when the option is deep-in- or out-of- the-money. (5 Marks) B. Call prices are directly related to the stock's volatility, yet higher volatility means that the stock price can go lower. How would you resolve this apparent paradox? (5 Marks) C. The value Max [0, X (1+r) -1 - Sy was shown to be the lowest possible value of a European put. Why is this value irrelevant for an American puti (5 Marks) D. Buying an at-the-money put has a greater return potential than buying an out-of- the-money put because it is more likely to be in-the-money. Appraise this statement. (5 Marks) E. Explain the advantages and disadvantages to a covered call writer of closing out the position prior to expiration. (5 Marks) Question 3 A. Explain why an option's time value is greatest when the stock price is near the exercise price and why it nearly disappears when the option is deep-in- or out-of- the-money. (5 Marks) B. Call prices are directly related to the stock's volatility, yet higher volatility means that the stock price can go lower. How would you resolve this apparent paradox? (5 Marks) C. The value Max [0, X (1+r) -1 - Sy was shown to be the lowest possible value of a European put. Why is this value irrelevant for an American puti (5 Marks) D. Buying an at-the-money put has a greater return potential than buying an out-of- the-money put because it is more likely to be in-the-money. Appraise this statement. (5 Marks) E. Explain the advantages and disadvantages to a covered call writer of closing out the position prior to expiration

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts