Question: QUESTION 3 A firm is evaluating two mutually exclusive projects that are projected to have the following cash flows: Year 2 Year 3 Initial investment

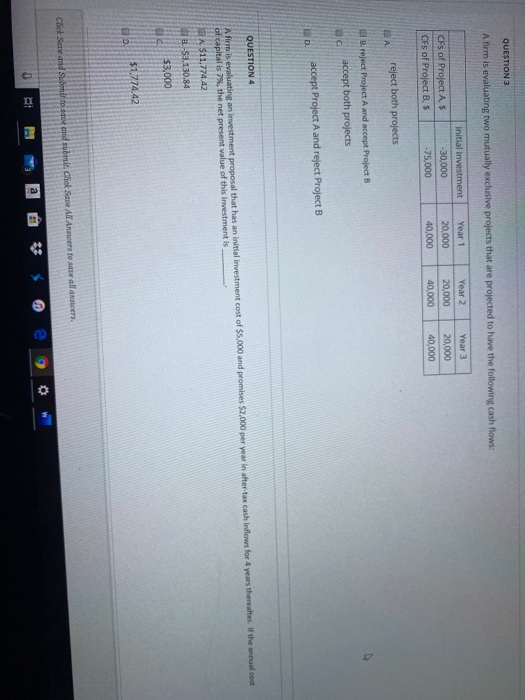

QUESTION 3 A firm is evaluating two mutually exclusive projects that are projected to have the following cash flows: Year 2 Year 3 Initial investment -30,000 -75,000 Year 20,000 40.000 20,000 CFs of Project AS CFs of Project B, S 20,000 20,000 40.000 40,000 reject both projects Breject Project A and accept Project B accept both projects accept Project A and reject Project B QUESTION 4 A firm is evaluating an investment proposal that has an initial investment cost of $5,000 and promises $2,000 per year in after-tax cash inflows for 4 years thereafter. If the annual cost of capital is 7%, the net present value of this investment is A $11.774.42 L-S3.130.84 $3,000 $1.774,42 Click Save and Subtrto save and submit. Click Save All Answers to save all answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts