Question: QUESTION 3 ( a ) Five years ago, AA Company issued 1 0 , 0 0 0 ( Ten Thousand ) 2 0 - year,

QUESTION

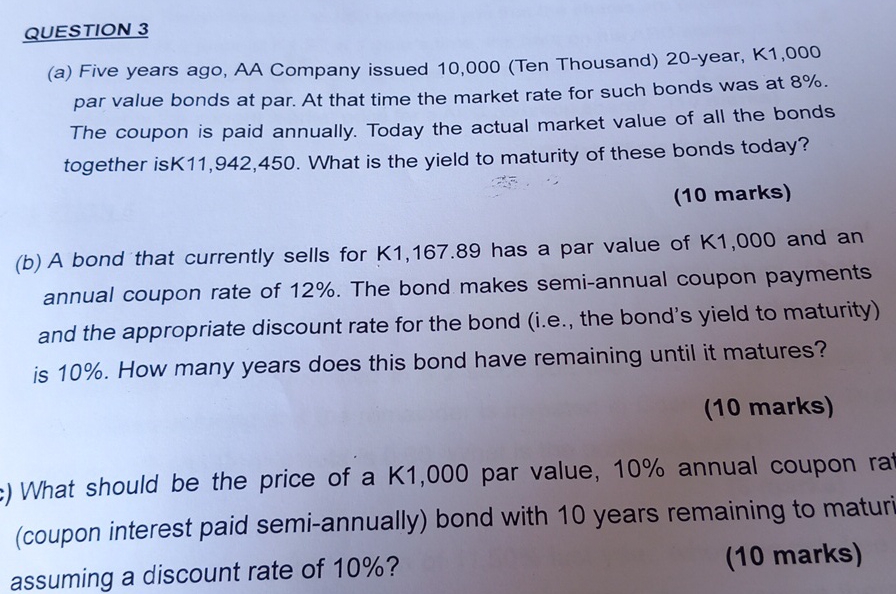

a Five years ago, AA Company issued Ten Thousandyear, K par value bonds at par. At that time the market rate for such bonds was at The coupon is paid annually. Today the actual market value of all the bonds together isK What is the yield to maturity of these bonds today?

marks

b A bond that currently sells for has a par value of and an annual coupon rate of The bond makes semiannual coupon payments and the appropriate discount rate for the bond ie the bond's yield to maturity is How many years does this bond have remaining until it matures?

marks

What should be the price of a par value, annual coupon rat coupon interest paid semiannually bond with years remaining to maturi assuming a discount rate of

marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock