Question: QUESTION 3 A. MCO implementation has had a significant impact on the production of crude palm oil (CPO) due to tight standard operating procedures (SOPs)

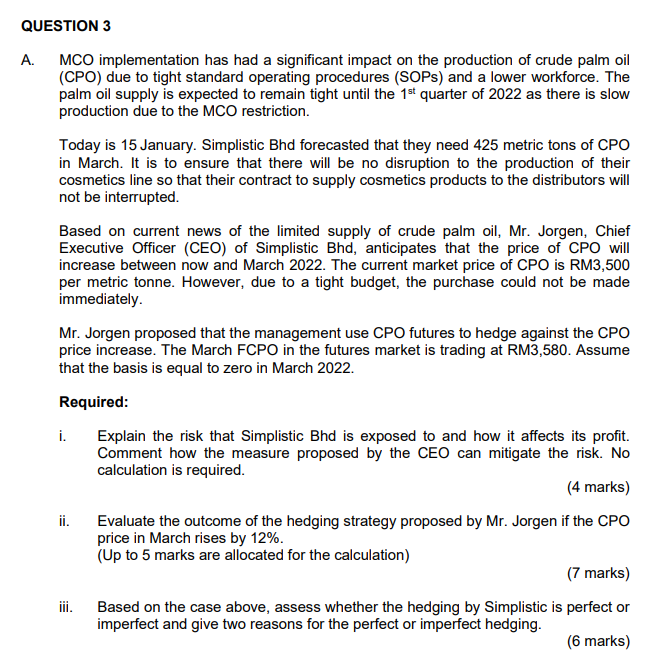

QUESTION 3 A. MCO implementation has had a significant impact on the production of crude palm oil (CPO) due to tight standard operating procedures (SOPs) and a lower workforce. The palm oil supply is expected to remain tight until the 1st quarter of 2022 as there is slow production due to the MCO restriction. Today is 15 January. Simplistic Bhd forecasted that they need 425 metric tons of CPO in March. It is to ensure that there will be no disruption to the production of their cosmetics line so that their contract to supply cosmetics products to the distributors will not be interrupted Based on current news of the limited supply of crude palm oil, Mr. Jorgen, Chief Executive Officer (CEO) of Simplistic Bhd, anticipates that the price of CPO will increase between now and March 2022. The current market price of CPO is RM3,500 per metric tonne. However, due to a tight budget, the purchase could not be made immediately Mr. Jorgen proposed that the management use CPO futures to hedge against the CPO price increase. The March FCPO in the futures market is trading at RM3,580. Assume that the basis is equal to zero in March 2022. Required: i. Explain the risk that Simplistic Bhd is exposed to and how it affects its profit. Comment how the measure proposed by the CEO can mitigate the risk. No calculation is required. (4 marks) ii. Evaluate the outcome of the hedging strategy proposed by Mr. Jorgen if the CPO price in March rises by 12%. (Up to 5 marks are allocated for the calculation) (7 marks) iii. Based on the case above, assess whether the hedging by Simplistic is perfect or imperfect and give two reasons for the perfect or imperfect hedging. (6 marks) QUESTION 3 A. MCO implementation has had a significant impact on the production of crude palm oil (CPO) due to tight standard operating procedures (SOPs) and a lower workforce. The palm oil supply is expected to remain tight until the 1st quarter of 2022 as there is slow production due to the MCO restriction. Today is 15 January. Simplistic Bhd forecasted that they need 425 metric tons of CPO in March. It is to ensure that there will be no disruption to the production of their cosmetics line so that their contract to supply cosmetics products to the distributors will not be interrupted Based on current news of the limited supply of crude palm oil, Mr. Jorgen, Chief Executive Officer (CEO) of Simplistic Bhd, anticipates that the price of CPO will increase between now and March 2022. The current market price of CPO is RM3,500 per metric tonne. However, due to a tight budget, the purchase could not be made immediately Mr. Jorgen proposed that the management use CPO futures to hedge against the CPO price increase. The March FCPO in the futures market is trading at RM3,580. Assume that the basis is equal to zero in March 2022. Required: i. Explain the risk that Simplistic Bhd is exposed to and how it affects its profit. Comment how the measure proposed by the CEO can mitigate the risk. No calculation is required. (4 marks) ii. Evaluate the outcome of the hedging strategy proposed by Mr. Jorgen if the CPO price in March rises by 12%. (Up to 5 marks are allocated for the calculation) (7 marks) iii. Based on the case above, assess whether the hedging by Simplistic is perfect or imperfect and give two reasons for the perfect or imperfect hedging. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts