Question: Question 3 (a) OCP Sdn Bhd (OCP) will embark on oleochemical production. OCP has engaged Denkin Co. Ltd., a tax resident in Japan to

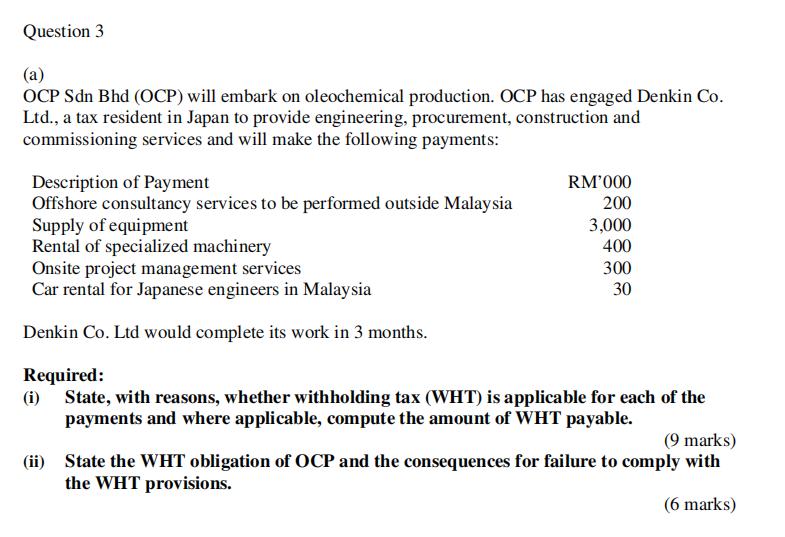

Question 3 (a) OCP Sdn Bhd (OCP) will embark on oleochemical production. OCP has engaged Denkin Co. Ltd., a tax resident in Japan to provide engineering, procurement, construction and commissioning services and will make the following payments: Description of Payment Offshore consultancy services to be performed outside Malaysia Supply of equipment Rental of specialized machinery Onsite project management services Car rental for Japanese engineers in Malaysia RM'000 200 3,000 400 300 30 Denkin Co. Ltd would complete its work in 3 months. Required: (i) State, with reasons, whether withholding tax (WHT) is applicable for each of the payments and where applicable, compute the amount of WHT payable. (9 marks) (ii) State the WHT obligation of OCP and the consequences for failure to comply with the WHT provisions. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

i Withholding tax WHT applicability and computation 1 Offshore consultancy services to be performed ... View full answer

Get step-by-step solutions from verified subject matter experts