Question: Question 3 (a) Setel Bhd has been presented with an investment opportunity which will yield cash flows of RM30,000 per year in Years 1 through

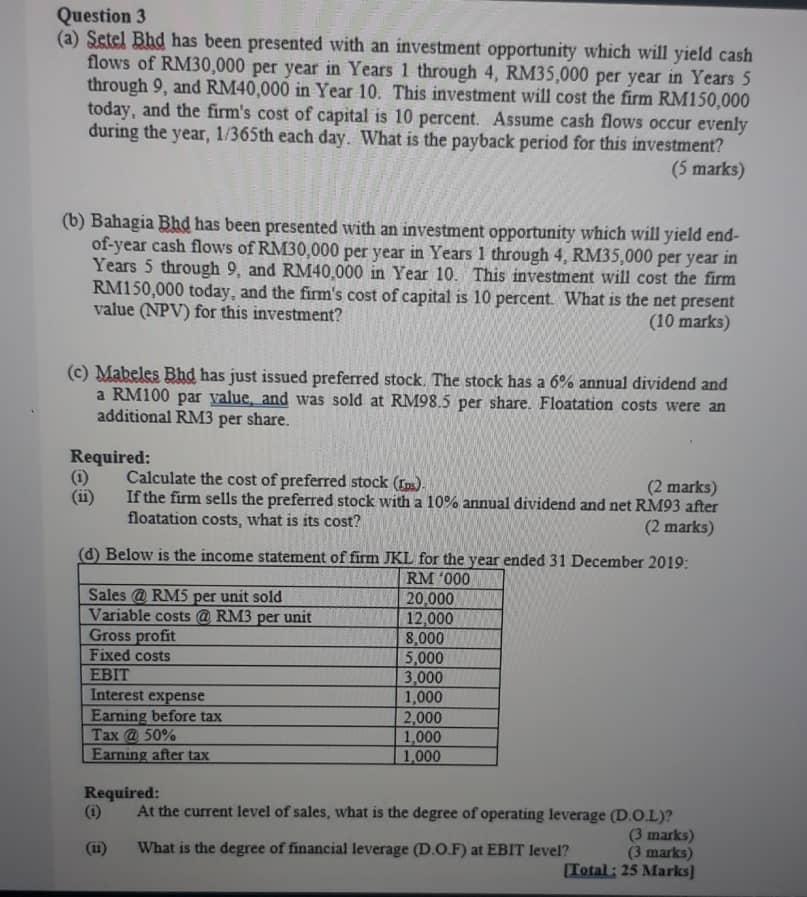

Question 3 (a) Setel Bhd has been presented with an investment opportunity which will yield cash flows of RM30,000 per year in Years 1 through 4, RM35,000 per year in Years 5 through 9, and RM40,000 in Year 10. This investment will cost the firm RM150,000 today, and the firm's cost of capital is 10 percent. Assume cash flows occur evenly during the year, 1/365th each day. What is the payback period for this investment? (5 marks) (b) Bahagia Bhd has been presented with an investment opportunity which will yield end- of-year cash flows of RM30,000 per year in Years 1 through 4, RM35,000 per year in Years 5 through 9, and RM40,000 in Year 10. This investment will cost the firm RM150,000 today, and the firm's cost of capital is 10 percent. What is the net present value (NPV) for this investment? (10 marks) (c) Mabeles Bhd has just issued preferred stock. The stock has a 6% annual dividend and a RM100 par value, and was sold at RM98.5 per share. Floatation costs were an additional RM3 per share. Required: Calculate the cost of preferred stock (Los) (2 marks) If the firm sells the preferred stock with a 10% annual dividend and net RM93 after floatation costs, what is its cost? (2 marks) (d) Below is the income statement of firm JKL for the year ended 31 December 2019 RM '000 Sales @ RM5 per unit sold 20,000 Variable costs @ RM3 per unit 12,000 Gross profit 8,000 Fixed costs 5,000 EBIT 3,000 Interest expense 1,000 Earning before tax 2,000 Tax @ 50% 1,000 Earning after tax 1.000 Required: At the current level of sales, what is the degree of operating leverage (D.O.L)? (3 marks) What is the degree of financial leverage (D.O.F) at EBIT level? (3 marks) [Total: 25 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts