Question: Question 3 a. What are the two rationales to provide deferred tax in financial statement (4 marks)? b. MNO Ltd made a profit before tax

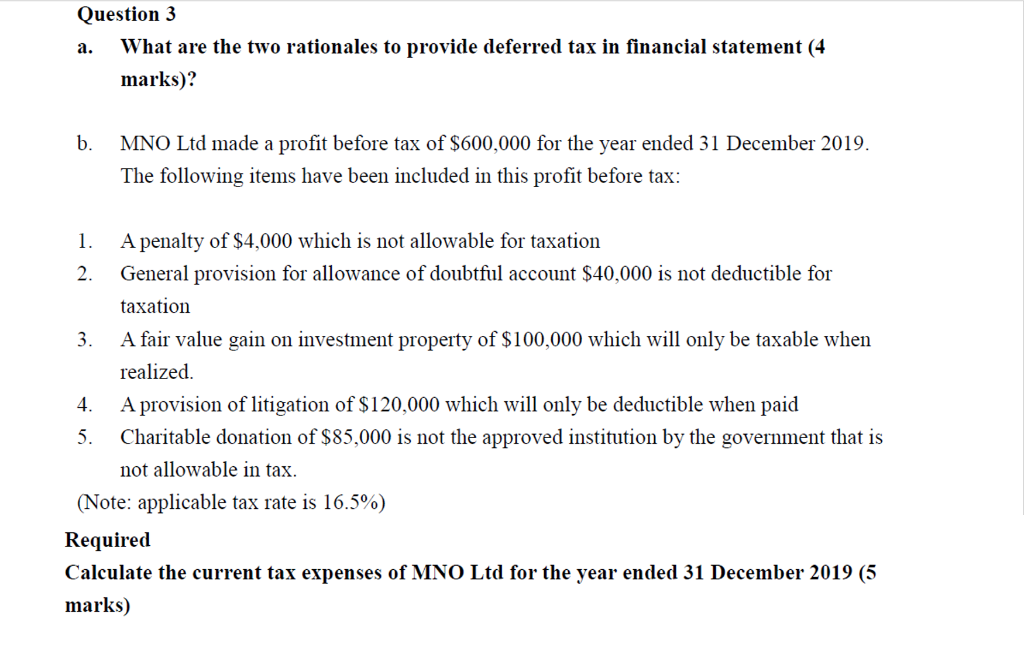

Question 3 a. What are the two rationales to provide deferred tax in financial statement (4 marks)? b. MNO Ltd made a profit before tax of $600,000 for the year ended 31 December 2019. The following items have been included in this profit before tax: 1. A penalty of $4,000 which is not allowable for taxation 2. General provision for allowance of doubtful account $40,000 is not deductible for taxation 3. A fair value gain on investment property of $100,000 which will only be taxable when realized. 4. A provision of litigation of $120,000 which will only be deductible when paid 5. Charitable donation of $85,000 is not the approved institution by the government that is not allowable in tax. (Note: applicable tax rate is 16.5%) Required Calculate the current tax expenses of MNO Ltd for the year ended 31 December 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts