Question: a. You have recently been employed to a small community based financial institution, Ironshore Community Savings & Loans, and you observe that there is

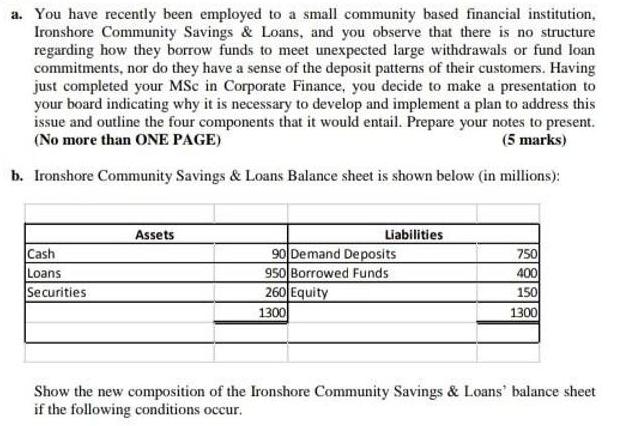

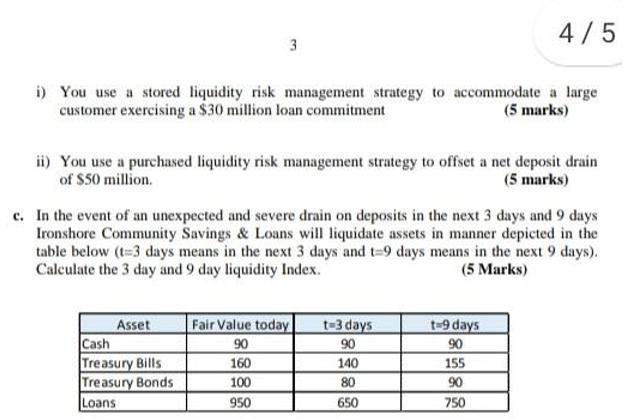

a. You have recently been employed to a small community based financial institution, Ironshore Community Savings & Loans, and you observe that there is no structure regarding how they borrow funds to meet unexpected large withdrawals or fund loan commitments, nor do they have a sense of the deposit patterns of their customers. Having just completed your MSc in Corporate Finance, you decide to make a presentation to your board indicating why it is necessary to develop and implement a plan to address this issue and outline the four components that it would entail. Prepare your notes to present. (No more than ONE PAGE) (5 marks) b. Ironshore Community Savings & Loans Balance sheet is shown below (in millions): Cash Loans Securities Assets Liabilities 90 Demand Deposits 950 Borrowed Funds 260 Equity 1300 750 400 150 1300 Show the new composition of the Ironshore Community Savings & Loans' balance sheet if the following conditions occur. 3 i) You use a stored liquidity risk management strategy to accommodate a large customer exercising a $30 million loan commitment (5 marks) ii) You use a purchased liquidity risk management strategy to offset a net deposit drain of $50 million. (5 marks) Asset c. In the event of an unexpected and severe drain on deposits in the next 3 days and 9 days Ironshore Community Savings & Loans will liquidate assets in manner depicted in the table below (t=3 days means in the next 3 days and t-9 days means in the next 9 days). Calculate the 3 day and 9 day liquidity Index. (5 Marks) Cash Treasury Bills Treasury Bonds Loans 4/5 Fair Value today 90 160 100 950 t-3 days 90 140 80 650 t-9 days 90 155 90 750

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

The question involves the Ironshore Community Savings Loans balance sheet and adjustments based on given scenarios as well as the calculation of liqui... View full answer

Get step-by-step solutions from verified subject matter experts