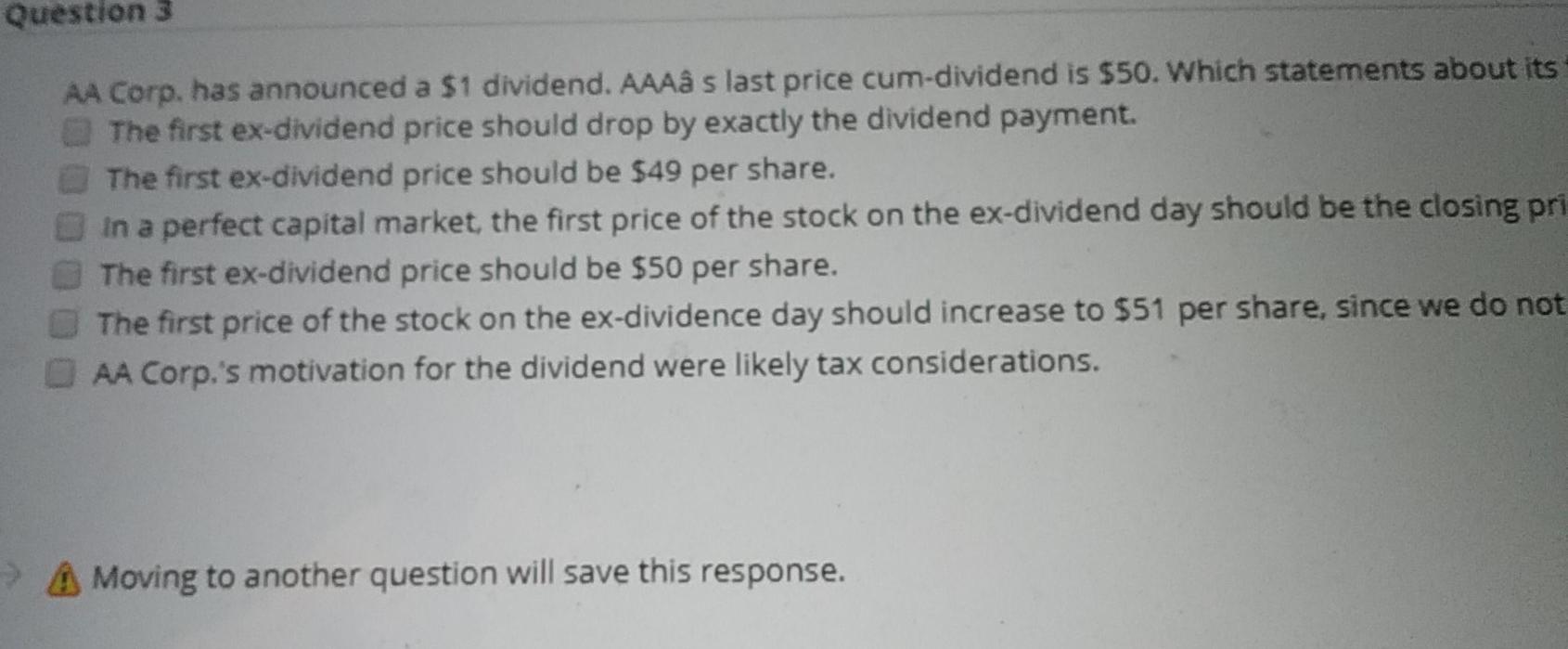

Question: Question 3 AA Corp. has announced a $1 dividend. AAA s last price cum-dividend is $50. Which statements about its The first ex-dividend price should

Question 3 AA Corp. has announced a $1 dividend. AAA s last price cum-dividend is $50. Which statements about its The first ex-dividend price should drop by exactly the dividend payment. The first ex-dividend price should be $49 per share. in a perfect capital market the first price of the stock on the ex-dividend day should be the closing pri The first ex-dividend price should be $50 per share. The first price of the stock on the ex-dividence day should increase to $51 per share, since we do not AA Corp.'s motivation for the dividend were likely tax considerations. > A Moving to another question will save this response. ts about its first ex-dividend price are correct, if you assume perfect capital markets? closing price on the previous dan dess the amount of the dividend. we do not consider taxes in perfect capital markets. Question 3 of 16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts