Question: Question 3 ABC needs a new machine to replace one of its old machines. The new machine costs $32,500 and has CCA rate of 20%.

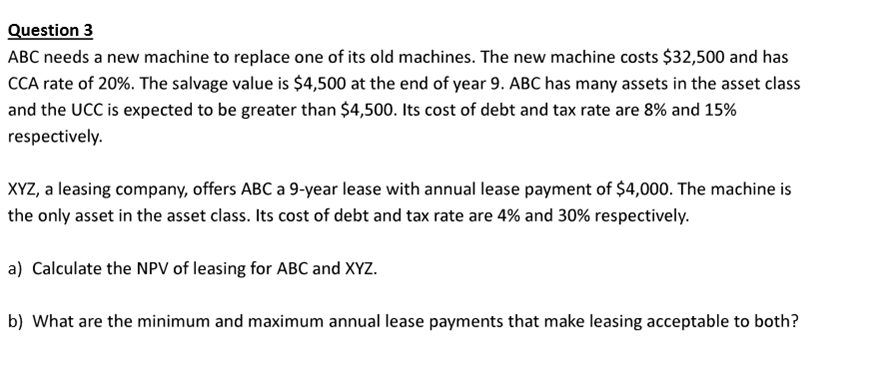

Question 3 ABC needs a new machine to replace one of its old machines. The new machine costs $32,500 and has CCA rate of 20%. The salvage value is $4,500 at the end of year 9 . ABC has many assets in the asset class and the UCC is expected to be greater than $4,500. Its cost of debt and tax rate are 8% and 15% respectively. XYZ, a leasing company, offers ABC a 9-year lease with annual lease payment of $4,000. The machine is the only asset in the asset class. Its cost of debt and tax rate are 4% and 30% respectively. a) Calculate the NPV of leasing for ABC and XYZ. b) What are the minimum and maximum annual lease payments that make leasing acceptable to both

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts