Question: Question 3 An Activity Based Costing (ABC) system is in operation in Interior Tiles Ltd which operates a wholesale business. The annual overheads of the

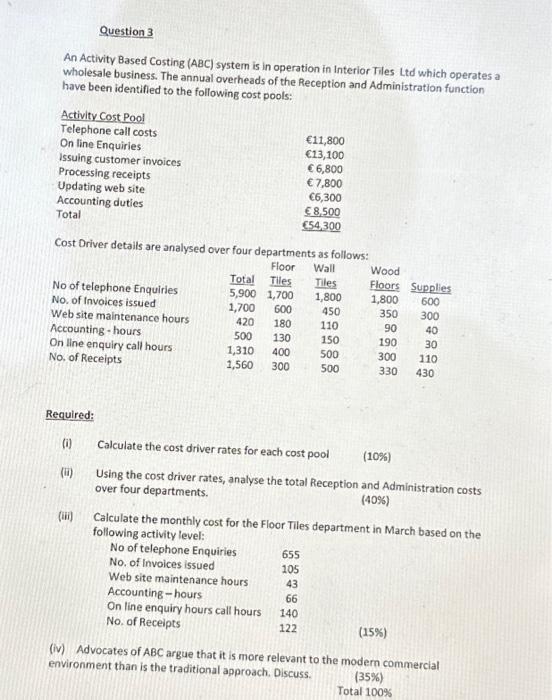

Question 3 An Activity Based Costing (ABC) system is in operation in Interior Tiles Ltd which operates a wholesale business. The annual overheads of the Reception and Administration function have been identifled to the following cost pools: Cost Driver details are analysed over four departments as follows: Required: (i) Calculate the cost driver rates for each cost pool (10%) (ii) Using the cost driver rates, analyse the total Reception and Administration costs over four departments. (40\%) (iii) Calculate the monthly cost for the Floor Tiles department in March based on the following activity level: (15%) (iv) Advocates of ABC argue that it is more relevant to the modern commercial environment than is the traditional approach. Discuss. (35\%) Total 100%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts