Question: Question (3): Answer the following question: (5 Marks) > A Wal-Mart bond you purchased two years ago for $890 is now selling for$925. The bond

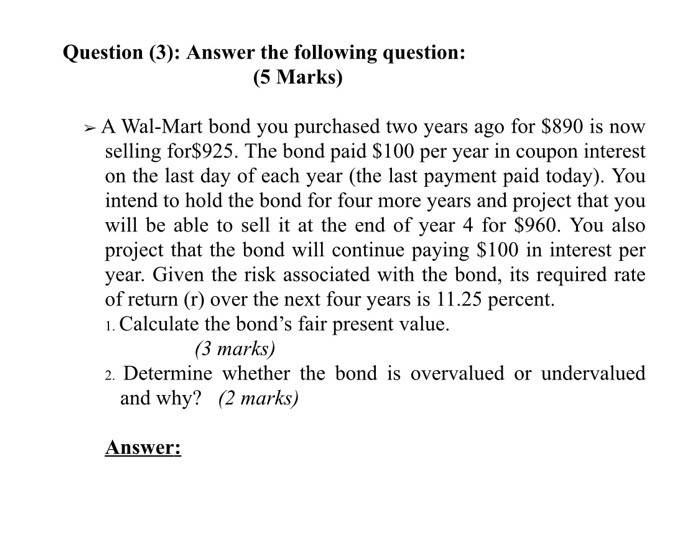

Question (3): Answer the following question: (5 Marks) > A Wal-Mart bond you purchased two years ago for $890 is now selling for$925. The bond paid $100 per year in coupon interest on the last day of each year (the last payment paid today). You intend to hold the bond for four more years and project that you will be able to sell it at the end of year 4 for $960. You also project that the bond will continue paying $100 in interest per year. Given the risk associated with the bond, its required rate of return (r) over the next four years is 11.25 percent. 1. Calculate the bond's fair present value. (3 marks) 2. Determine whether the bond is overvalued or undervalued and why? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts