Question: Question 3 Assume that Amazon.com has a stock-option plan for top management. Each stock option represents the right to purchase a share of Amazon $1

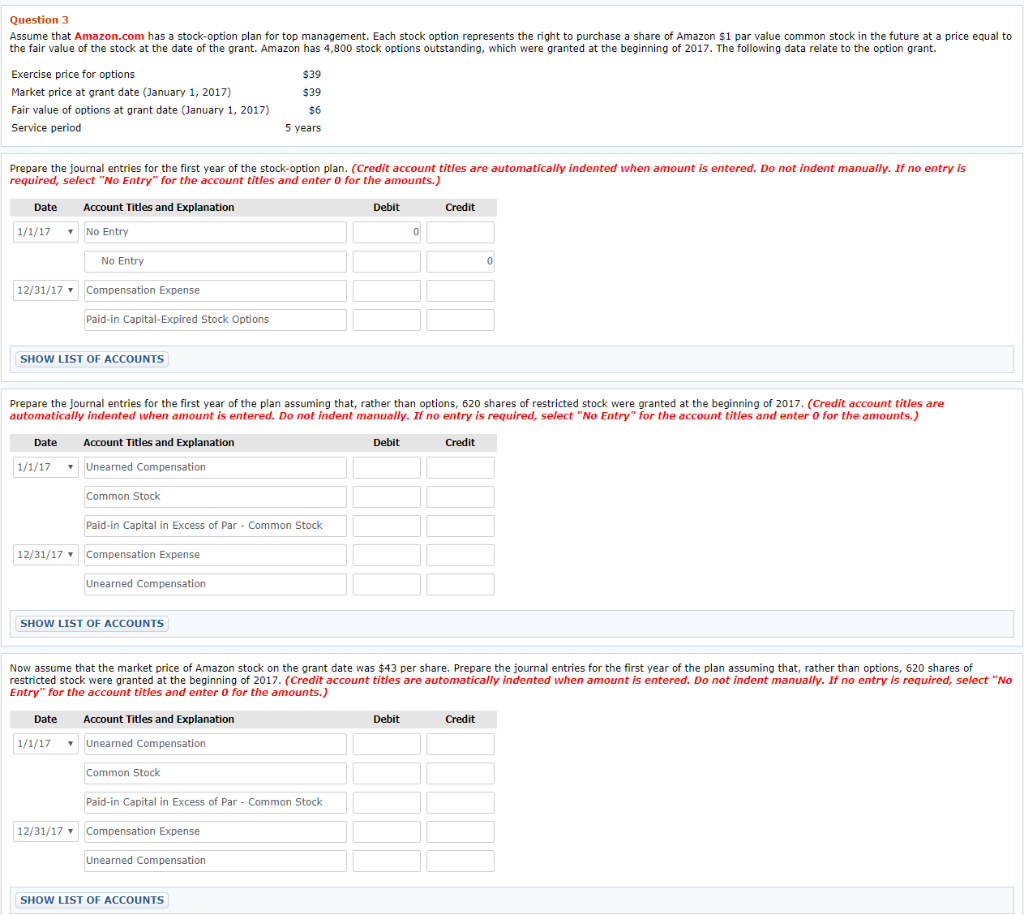

Question 3 Assume that Amazon.com has a stock-option plan for top management. Each stock option represents the right to purchase a share of Amazon $1 par value common stock in the future at a price equal to the fair value of the stock at the date of the grant. Amazon has 4,800 stock options outstanding, which were granted at the beginning of 2017. The following data relate to the option grant. Exercise price for options Market price at grant date (January 1, 2017) Fair value of options at grant date (January 1, 2017) Service period S39 $39 $6 5 years Prepare the journal entries for the first year of the stock-option plan. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit 1/1/17 No Entry No Entry 12/31/17 Compensation Expense Paid-in Capital-Expired Stock Options SHOW LIST OF ACCOUNTS Prepare the journal entries for the first year of the plan assuming that, rather than options, 620 shares of restricted stock were granted at the beginning of 2017. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit 1/1/17 ' Unearned Compensation Common Stock Paid-in Capital in Excess of Par - Common Stock 12/31/17 Compensation Expense Unearned Compensation SHOW LIST OF ACCOUNTS Now assume that the market price of Amazon stock on the grant date was $43 per share. Prepare the journal entries for the first year of the plan assuming that, rather than options, 620 shares of restricted stock were granted at the beginning of 2017. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit 1/1/17 Unearned Compensation Common Stock Paid-in Capital in Excess of Par - Common Stock 12/31/17Compensation Expense Unearned Compensation SHOW LIST OF ACCOUNTS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts