Question: Question 3 Assume that the CAPM is a good description of stock price returns. The market return is 12% with 12% volatility and the risk-free

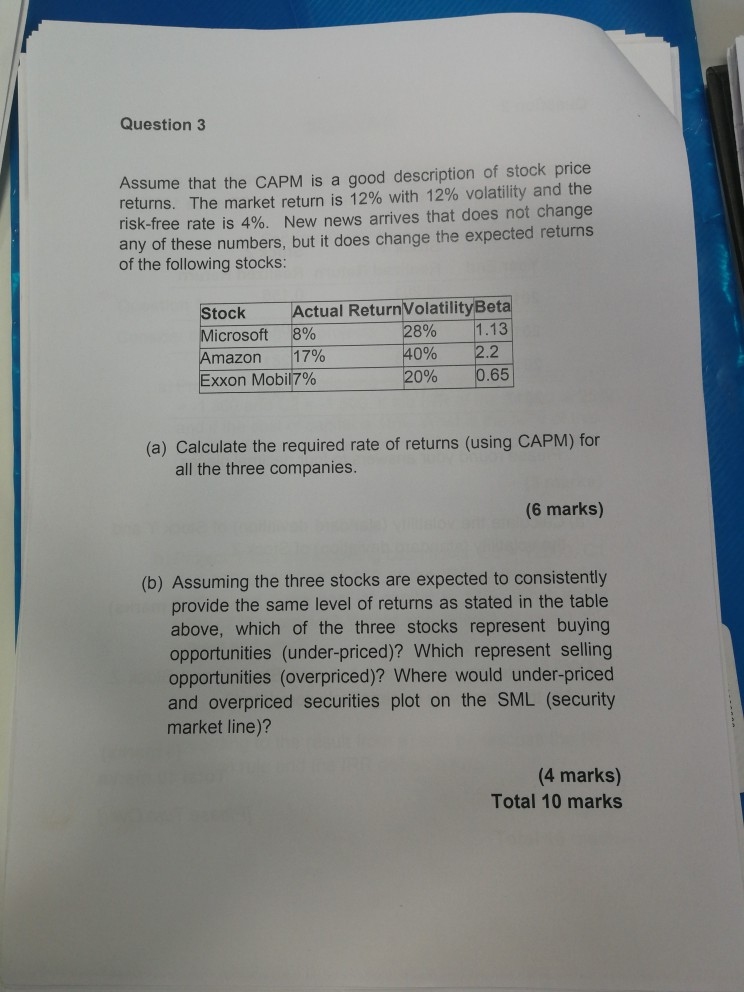

Question 3 Assume that the CAPM is a good description of stock price returns. The market return is 12% with 12% volatility and the risk-free rate is 4%. New news arrives that does not change any of these numbers, but it does change the expected returns of the following stocks: Actual ReturnVolatilityBeta Stock |1.13 2 28% 40% icrosoft 8% mazon 17% Exxon Mobi17% 2090 065 (a) Calculate the required rate of returns (using CAPM) for all the three companies (6 marks) (b) Assuming the three stocks are expected to consistently provide the same level of returns as stated in the table above, which of the three stocks represent buying opportunities (under-priced)? Which represent selling opportunities (overpriced)? Where would under-priced and overpriced securities plot on the SML (security market line)? (4 marks) Total 10 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts