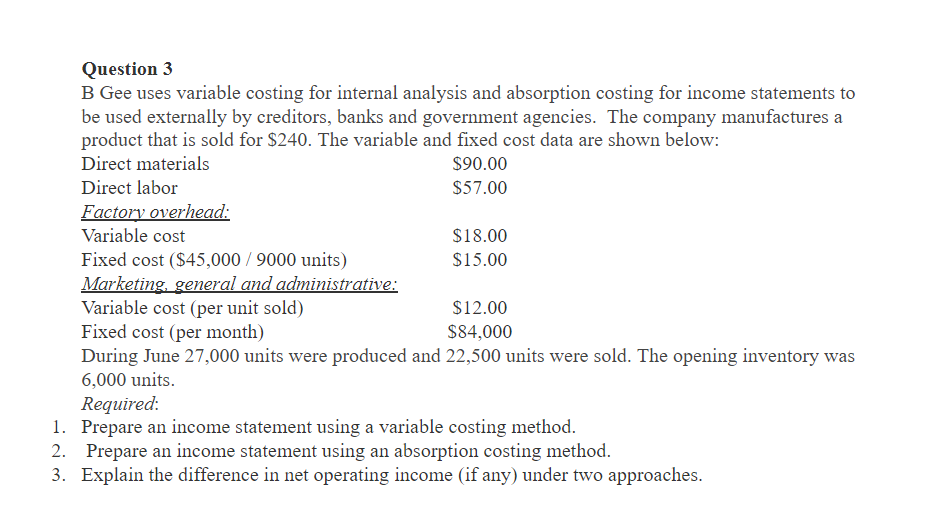

Question: Question 3 B Gee uses variable costing for internal analysis and absorption costing for income statements to be used externally by creditors, banks and government

Question 3 B Gee uses variable costing for internal analysis and absorption costing for income statements to be used externally by creditors, banks and government agencies. The company manufactures a product that is sold for $240. The variable and fixed cost data are shown below: Direct materials $90.00 Direct labor $57.00 Factory overhead: Variable cost $18.00 Fixed cost ($45,000 / 9000 units) $15.00 Marketing, general and administrative: Variable cost (per unit sold) $12.00 Fixed cost (per month) $84,000 During June 27,000 units were produced and 22,500 units were sold. The opening inventory was 6,000 units. Required: 1. Prepare an income statement using a variable costing method. 2. Prepare an income statement using an absorption costing method. 3. Explain the difference in net operating income (if any) under two approaches

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts