Question: Question 3 Banks have been faced with additional demand for loans from corporates, bond rating downgrades and corporate credit defaults during the Covid-19 pandemic. Interest

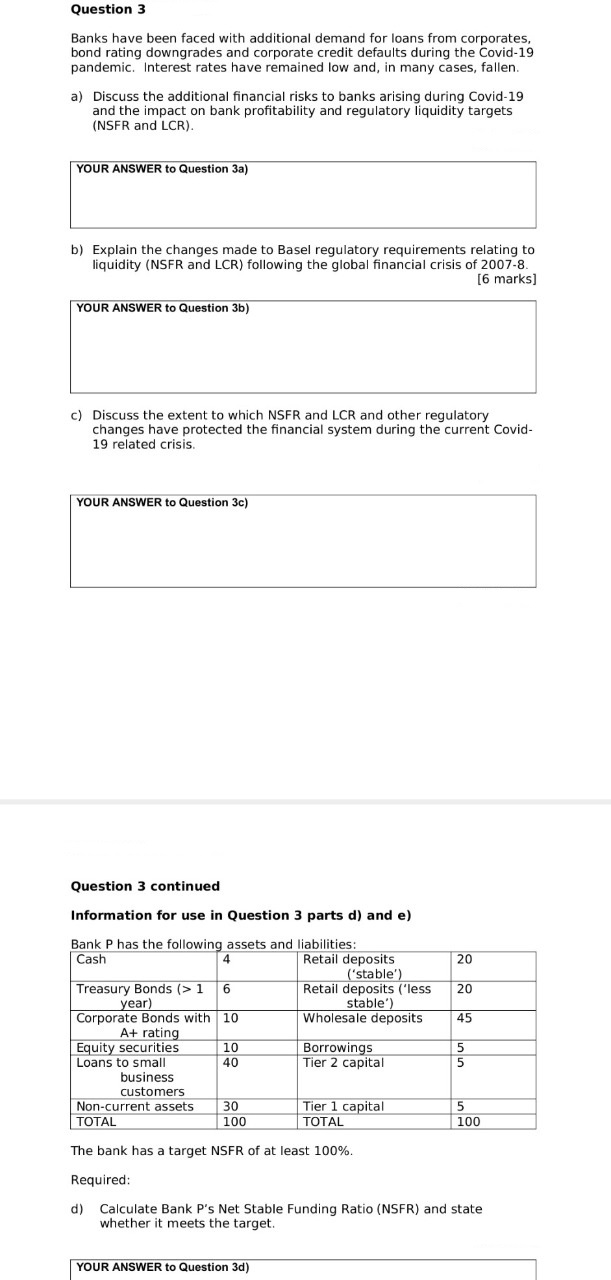

Question 3 Banks have been faced with additional demand for loans from corporates, bond rating downgrades and corporate credit defaults during the Covid-19 pandemic. Interest rates have remained low and, in many cases, fallen. a) Discuss the additional financial risks to banks arising during Covid-19 and the impact on bank profitability and regulatory liquidity targets (NSFR and LCR). YOUR ANSWER to Question 3a) b) Explain the changes made to Basel regulatory requirements relating to liquidity (NSFR and LCR) following the global financial crisis of 2007-8. [6 marks] YOUR ANSWER to Question 3b) c) Discuss the extent to which NSFR and LCR and other regulatory changes have protected the financial system during the current Covid- 19 related crisis YOUR ANSWER to Question 3c) Question 3 continued Information for use in Question 3 parts d) and e) 20 20 45 Bank P has the following assets and liabilities: Cash 4 Retail deposits ('stable') Treasury Bonds (> 1 6 Retail deposits ('less year) stable') Corporate Bonds with 10 Wholesale deposits A+ rating Equity securities 10 Borrowings Loans to small 40 Tier 2 capital business customers Non-current assets 30 Tier 1 capital | TOTAL 100 TOTAL 5 5 5 100 The bank has a target NSFR of at least 100%. Required: d) Calculate Bank P's Net Stable Funding Ratio (NSFR) and state whether it meets the target. YOUR ANSWER to Question 3d)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts