Question: Question 3 below is an application of the classical value theory to real-time financial market trading. It is intended for students to better connect the

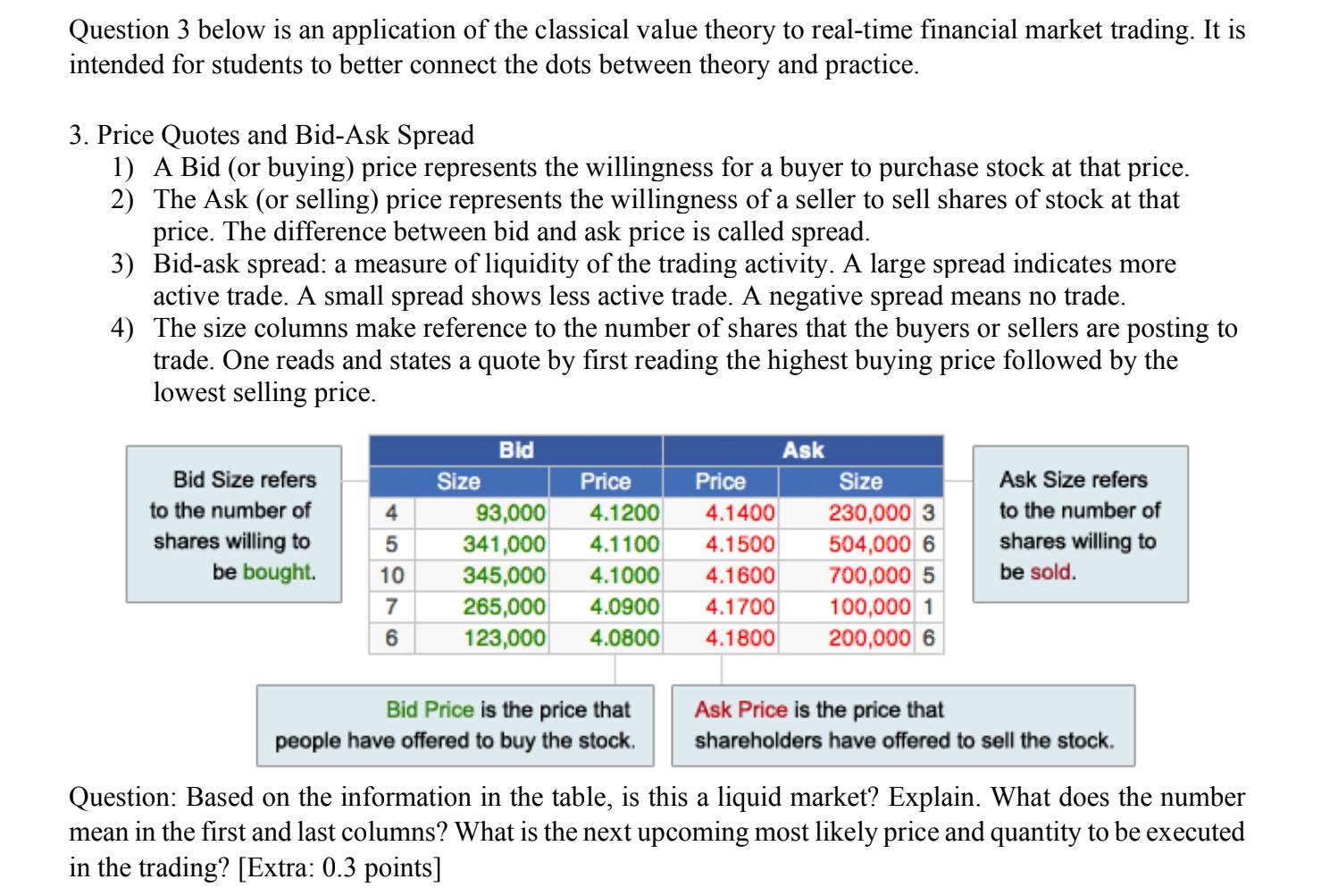

Question 3 below is an application of the classical value theory to real-time financial market trading. It is intended for students to better connect the dots between theory and practice. 3. Price Quotes and Bid-Ask Spread 1) A Bid (or buying) price represents the willingness for a buyer to purchase stock at that price. 2) The Ask (or selling) price represents the willingness of a seller to sell shares of stock at that price. The difference between bid and ask price is called spread. 3) Bid-ask spread: a measure of liquidity of the trading activity. A large spread indicates more active trade. A small spread shows less active trade. A negative spread means no trade. 4) The size columns make reference to the number of shares that the buyers or sellers are posting to trade. One reads and states a quote by first reading the highest buying price followed by the lowest selling price. \begin{tabular}{|} Bid Size refers \\ to the number of \\ shares willing to \\ be bought. \\ \hline \end{tabular} \begin{tabular}{l} Ask Size refers \\ to the number of \\ shares willing to \\ be sold. \\ \hline \end{tabular} \begin{tabular}{l} Bid Price is the price that \\ people have offered to buy the stock. \\ \hline \end{tabular} Ask Price is the price that shareholders have offered to sell the stock. Question: Based on the information in the table, is this a liquid market? Explain. What does the number mean in the first and last columns? What is the next upcoming most likely price and quantity to be executed in the trading? [Extra: 0.3 points] Question 3 below is an application of the classical value theory to real-time financial market trading. It is intended for students to better connect the dots between theory and practice. 3. Price Quotes and Bid-Ask Spread 1) A Bid (or buying) price represents the willingness for a buyer to purchase stock at that price. 2) The Ask (or selling) price represents the willingness of a seller to sell shares of stock at that price. The difference between bid and ask price is called spread. 3) Bid-ask spread: a measure of liquidity of the trading activity. A large spread indicates more active trade. A small spread shows less active trade. A negative spread means no trade. 4) The size columns make reference to the number of shares that the buyers or sellers are posting to trade. One reads and states a quote by first reading the highest buying price followed by the lowest selling price. \begin{tabular}{|} Bid Size refers \\ to the number of \\ shares willing to \\ be bought. \\ \hline \end{tabular} \begin{tabular}{l} Ask Size refers \\ to the number of \\ shares willing to \\ be sold. \\ \hline \end{tabular} \begin{tabular}{l} Bid Price is the price that \\ people have offered to buy the stock. \\ \hline \end{tabular} Ask Price is the price that shareholders have offered to sell the stock. Question: Based on the information in the table, is this a liquid market? Explain. What does the number mean in the first and last columns? What is the next upcoming most likely price and quantity to be executed in the trading? [Extra: 0.3 points]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts