Question: Characteristic Value for Bond 1 Question 3. Below is the information sheet for 2 option-embedded bonds. Value for Bond 2 Type Government Corporate Maturity

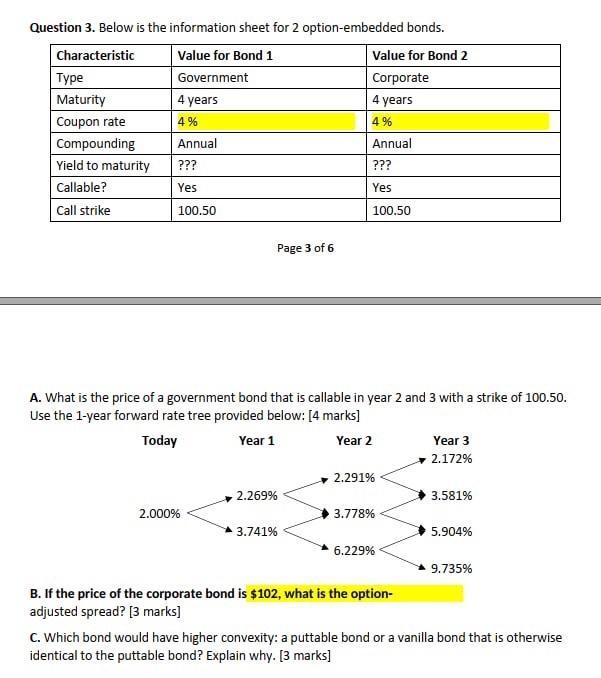

Characteristic Value for Bond 1 Question 3. Below is the information sheet for 2 option-embedded bonds. Value for Bond 2 Type Government Corporate Maturity 4 years 4 years Coupon rate 4% 4% Compounding Annual Annual Yield to maturity ??? ??? Callable? Yes Yes Call strike 100.50 100.50 Page 3 of 6 A. What is the price of a government bond that is callable in year 2 and 3 with a strike of 100.50. Use the 1-year forward rate tree provided below: [4 marks] Today Year 1 Year 2 Year 3 2.172% 2.291% 2.269% 3.581% 2.000% 3.778% 3.741% 5.904% 6.229% 9.735% B. If the price of the corporate bond is $102, what is the option- adjusted spread? [3 marks] C. Which bond would have higher convexity: a puttable bond or a vanilla bond that is otherwise identical to the puttable bond? Explain why. [3 marks]

Step by Step Solution

There are 3 Steps involved in it

Answering the questions based on the information provided A Price of the Callable Government Bond Unfortunately with only the information sheet and the forward rate tree we cannot definitively determi... View full answer

Get step-by-step solutions from verified subject matter experts