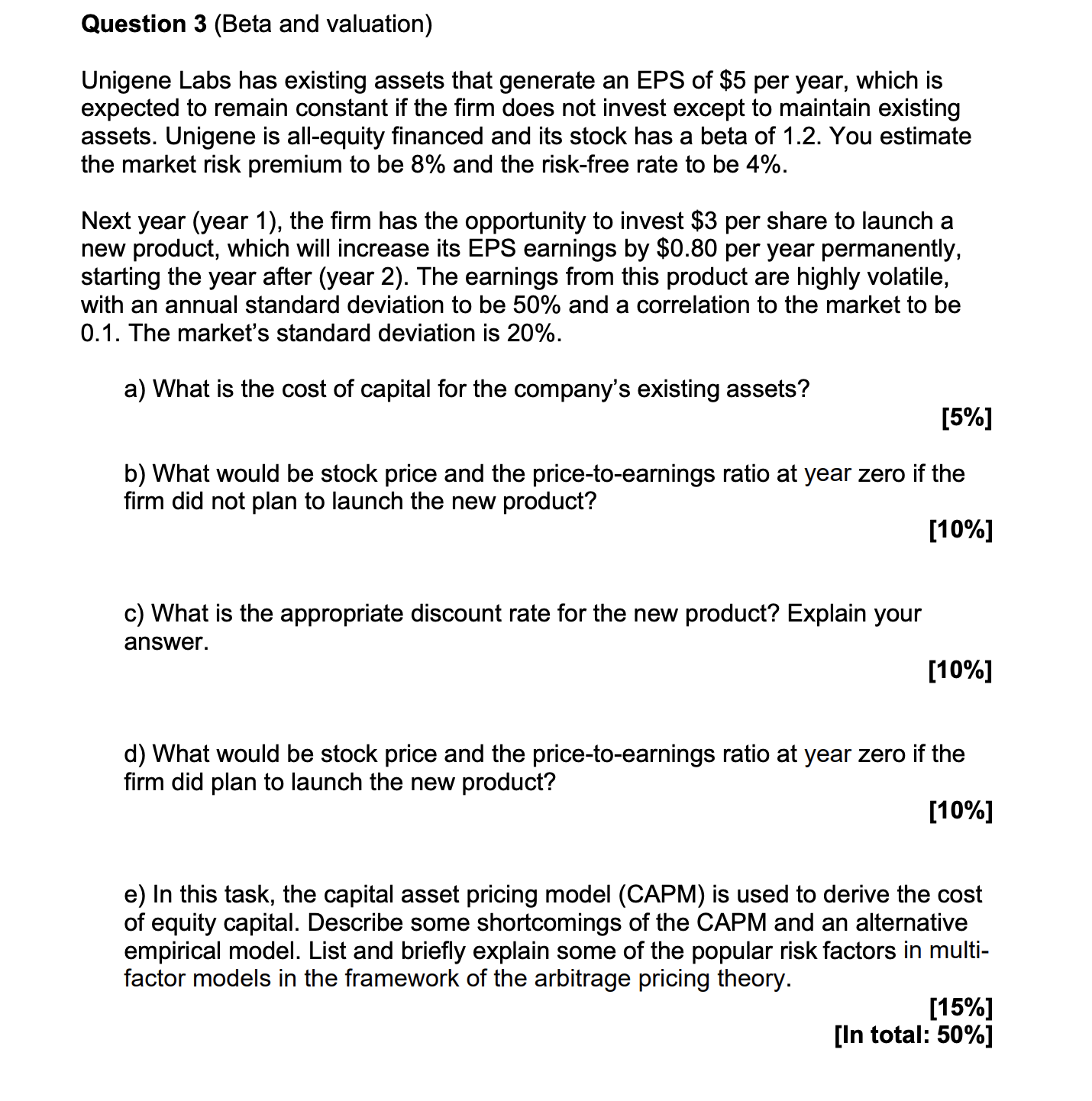

Question: Question 3 ( Beta and valuation ) Unigene Labs has existing assets that generate an EPS of $ 5 per year, which is expected to

Question Beta and valuation

Unigene Labs has existing assets that generate an EPS of $ per year, which is

expected to remain constant if the firm does not invest except to maintain existing

assets. Unigene is allequity financed and its stock has a beta of You estimate

the market risk premium to be and the riskfree rate to be

Next year year the firm has the opportunity to invest $ per share to launch a

new product, which will increase its EPS earnings by $ per year permanently,

starting the year after year The earnings from this product are highly volatile,

with an annual standard deviation to be and a correlation to the market to be

The market's standard deviation is

a What is the cost of capital for the company's existing assets?

b What would be stock price and the pricetoearnings ratio at year zero if the

firm did not plan to launch the new product?

c What is the appropriate discount rate for the new product? Explain your

answer.

d What would be stock price and the pricetoearnings ratio at year zero if the

firm did plan to launch the new product?

e In this task, the capital asset pricing model CAPM is used to derive the cost

of equity capital. Describe some shortcomings of the CAPM and an alternative

empirical model. List and briefly explain some of the popular risk factors in multi

factor models in the framework of the arbitrage pricing theory.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock