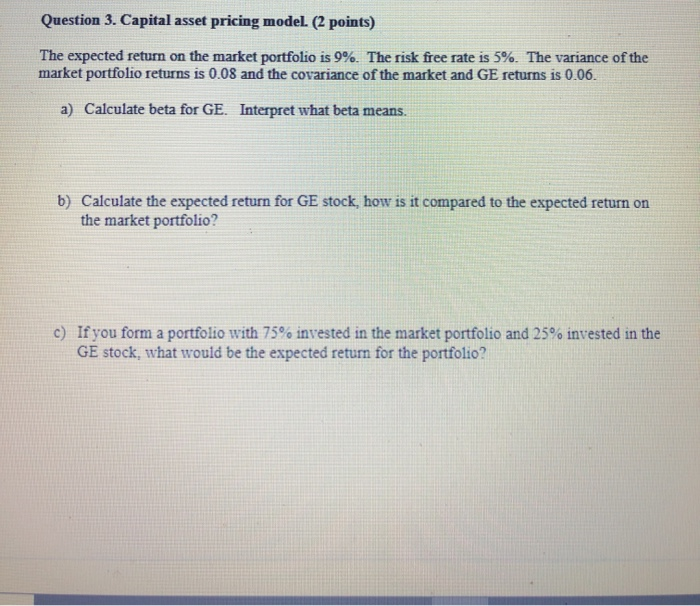

Question: Question 3. Capital asset pricing model. (2 points) The expected return on the market portfolio is 9%. The risk free rate is 5%. The variance

Question 3. Capital asset pricing model. (2 points) The expected return on the market portfolio is 9%. The risk free rate is 5%. The variance of the market portfolio returns is 0.08 and the covariance of the market and GE returns is 0.06. Calculate beta for GE. a) Interpret what beta means. b) Calculate the expected return for GE stock, how is it compared to the expected return on the market portfolio? c) If you form a portfolio with 75% invested in the market portfolio and 25% invested in the GE stock, what would be the expected return for the portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts