Question: QUESTION 3 Company A issues 100,000 1 redeemable convertible notes. The notes pay interest at 5%. They convert at any time at the option of

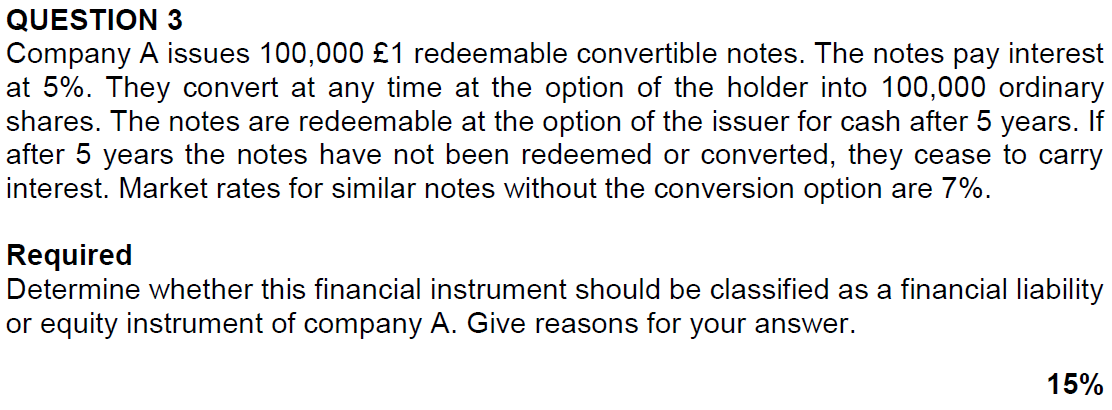

QUESTION 3 Company A issues 100,000 1 redeemable convertible notes. The notes pay interest at 5%. They convert at any time at the option of the holder into 100,000 ordinary shares. The notes are redeemable at the option of the issuer for cash after 5 years. If after 5 years the notes have not been redeemed or converted, they cease to carry interest. Market rates for similar notes without the conversion option are 7%. Required Determine whether this financial instrument should be classified as a financial liability or equity instrument of company A. Give reasons for your answer. 15%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock