Question: Question 3? Completed question 1 is attached 3. ROE and Leverage. Suppose the company in Problem l has a market-to-book ratio of 1.0. [Hint: market-to-book

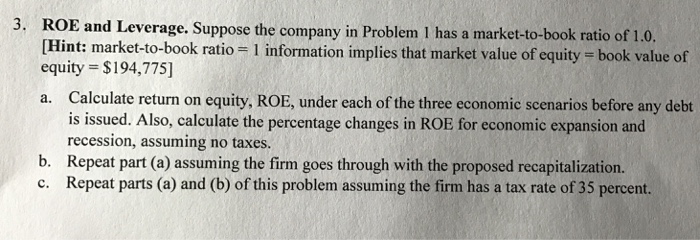

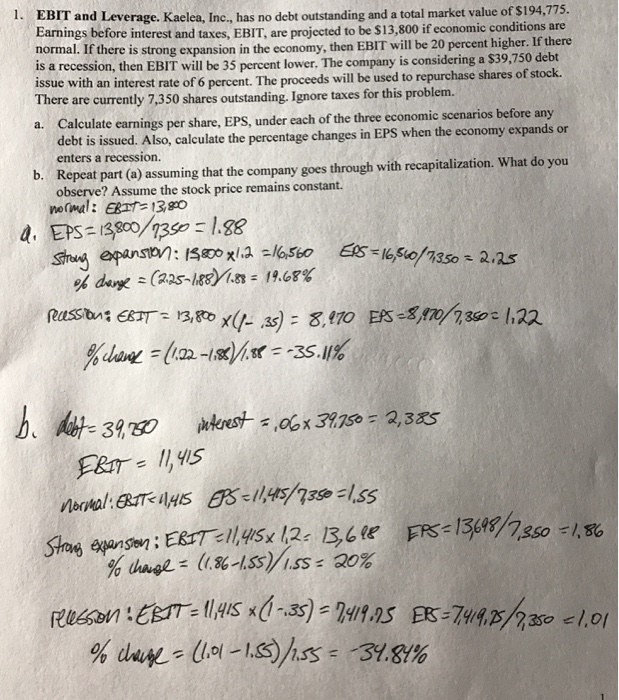

3. ROE and Leverage. Suppose the company in Problem l has a market-to-book ratio of 1.0. [Hint: market-to-book ratio 1 information implies that market value of equity book value of equity $194,775] a. Calculate return on equity, ROE, under each of the three economic scenarios before any debt is issued. Also, calculate the percentage changes in RoE for economic expansion and recession, assuming no taxes. b. Repeat part (a) assuming the firm goes through with the proposed recapitalization. c. Repeat parts (a) and (b) of this problem assuming the firm has a tax rate of 35 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts