Question: Question 3 Consider a standard auction setting with two bidders (i=1,2) whose value (vi) are independent and identically distributed by a uniform distribution U[0,1]. Each

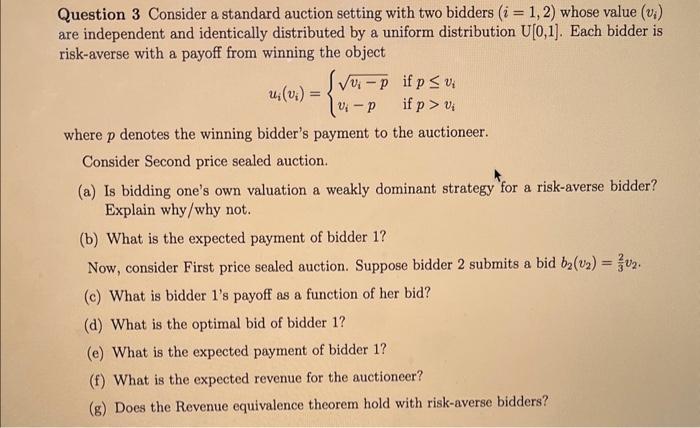

Question 3 Consider a standard auction setting with two bidders (i=1,2) whose value (vi) are independent and identically distributed by a uniform distribution U[0,1]. Each bidder is risk-averse with a payoff from winning the object ui(vi)={vipvipifpviifp>vi where p denotes the winning bidder's payment to the auctioneer. Consider Second price sealed auction. (a) Is bidding one's own valuation a weakly dominant strategy for a risk-averse bidder? Explain why/why not. (b) What is the expected payment of bidder 1 ? Now, consider First price sealed auction. Suppose bidder 2 submits a bid b2(v2)=32v2. (c) What is bidder 1 's payoff as a function of her bid? (d) What is the optimal bid of bidder 1 ? (e) What is the expected payment of bidder 1 ? (f) What is the expected revenue for the auctioneer? (g) Does the Revenue equivalence theorem hold with risk-averse bidders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts