Question: Question 3 Consider a stock that pays dividends and whose current price is $40. The binomial tree below describes the possible stock prices over the

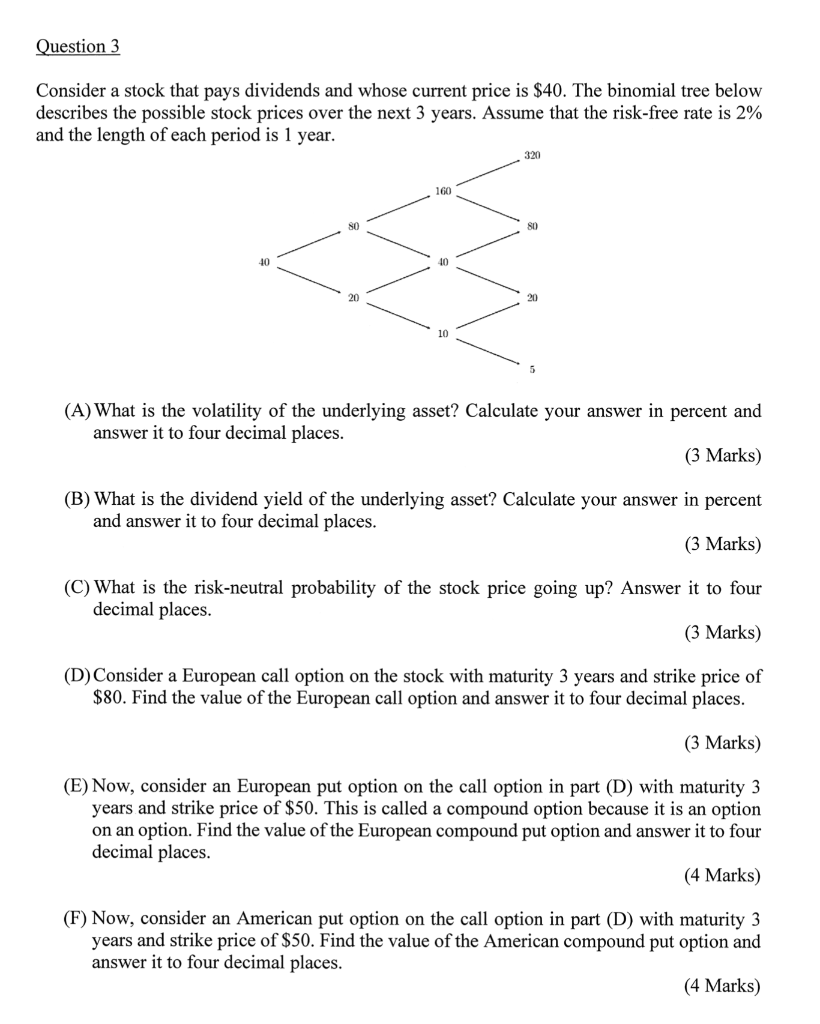

Question 3 Consider a stock that pays dividends and whose current price is $40. The binomial tree below describes the possible stock prices over the next 3 years. Assume that the risk-free rate is 2% and the length of each period is 1 year. 320 160 80 40 10 (A) What is the volatility of the underlying asset? Calculate your answer in percent and answer it to four decimal places. (3 Marks) (B) What is the dividend yield of the underlying asset? Calculate your answer in percent and answer it to four decimal places. (3 Marks) (C) What is the risk-neutral probability of the stock price going up? Answer it to four decimal places. (3 Marks) (D) Consider a European call option on the stock with maturity 3 years and strike price of $80. Find the value of the European call option and answer it to four decimal places. (3 Marks) (E) Now, consider an European put option on the call option in part (D) with maturity 3 years and strike price of $50. This is called a compound option because it is an option on an option. Find the value of the European compound put option and answer it to four decimal places. (4 Marks) (F) Now, consider an American put option on the call option in part (D) with maturity 3 years and strike price of $50. Find the value of the American compound put option and answer it to four decimal places. (4 Marks) Question 3 Consider a stock that pays dividends and whose current price is $40. The binomial tree below describes the possible stock prices over the next 3 years. Assume that the risk-free rate is 2% and the length of each period is 1 year. 320 160 80 40 10 (A) What is the volatility of the underlying asset? Calculate your answer in percent and answer it to four decimal places. (3 Marks) (B) What is the dividend yield of the underlying asset? Calculate your answer in percent and answer it to four decimal places. (3 Marks) (C) What is the risk-neutral probability of the stock price going up? Answer it to four decimal places. (3 Marks) (D) Consider a European call option on the stock with maturity 3 years and strike price of $80. Find the value of the European call option and answer it to four decimal places. (3 Marks) (E) Now, consider an European put option on the call option in part (D) with maturity 3 years and strike price of $50. This is called a compound option because it is an option on an option. Find the value of the European compound put option and answer it to four decimal places. (4 Marks) (F) Now, consider an American put option on the call option in part (D) with maturity 3 years and strike price of $50. Find the value of the American compound put option and answer it to four decimal places. (4 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts