Question: QUESTION 3 Consider an MPT with WAC=5% with par value of $5,000,000. There is a servicing fee of 0.4% a year for this security. Mark

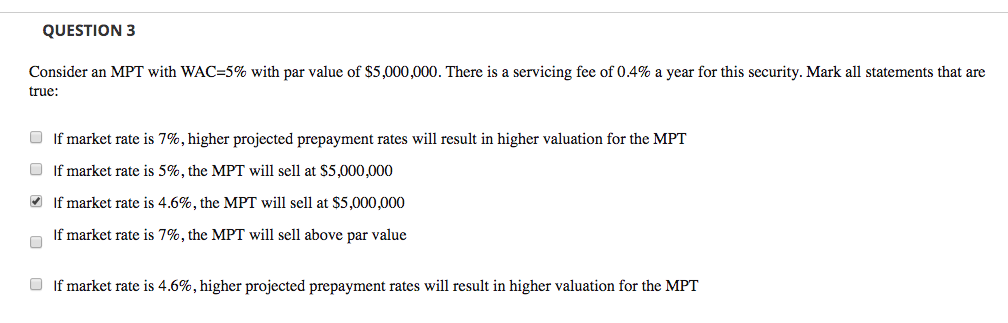

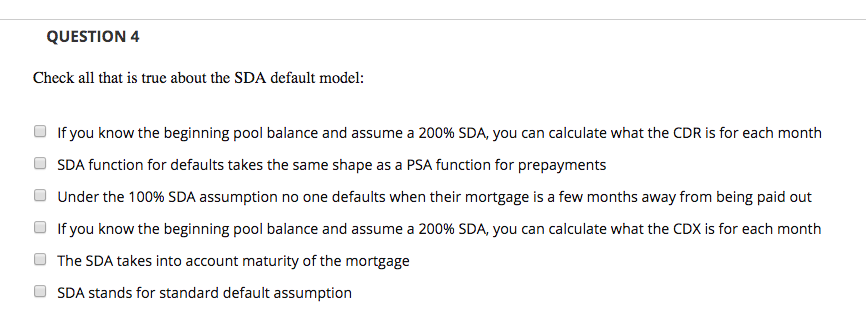

QUESTION 3 Consider an MPT with WAC=5% with par value of $5,000,000. There is a servicing fee of 0.4% a year for this security. Mark all statements that are true: If market rate is 7%, higher projected prepayment rates will result in higher valuation for the MPT If market rate is 5%, the MPT will sell at $5,000,000 If market rate is 4.6%, the MPT will sell at $5,000,000 If market rate is 7%, the MPT will sell above par value If market rate is 4.6%, higher projected prepayment rates will result in higher valuation for the MPT QUESTION 4 Check all that is true about the SDA default model: If you know the beginning pool balance and assume a 200% SDA, you can calculate what the CDR is for each month SDA function for defaults takes the same shape as a PSA function for prepayments Under the 100% SDA assumption no one defaults when their mortgage is a few months away from being paid out If you know the beginning pool balance and assume a 200% SDA, you can calculate what the CDX is for each month The SDA takes into account maturity of the mortgage SDA stands for standard default assumption

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts